Overview of Sole Proprietorship Registration

As we know, India is mainly a middle-class country and is full of people who are managing and running their business as a Sole Proprietorship Firm. Also, Sole Proprietorship Firm Registration is chosen mainly by the Micro and Small Enterprises, which operate in the unorganised sector with minimal investment.

Also, some of the examples of this business model are Photo Studios, Chemist Shops, Salons, Grocery Store, etc.

Concept of Sole Proprietorship

The term “Sole Proprietorship” refers to a business model that is not only the simplest and easiest to form but needs just minimal legal formalities as well. Also, there is no such governing law for regulating the registration of sole proprietorship.

Concept of Sole Proprietor

The term “Sole Proprietor” denotes a living individual who is the owner of the business. Also, it shall be taken into consideration that such an individual must be an Indian Citizen and a Resident as well. Further, a sole proprietor is solely responsible for all the profits earned and the losses incurred.

Advantages of Sole Proprietorship Firm

The advantages of a Sole Proprietorship Firm are as follows:

- A Proprietorship Firm is not mandated to obtain Compulsory Registration;

- An individual can start a Sole Proprietorship Firm without any intricate formalities;

- There is no need for a Sole Proprietor to get his/ her accounts audited statements with the MCA each year;

- A Sole Proprietor who is earning less than Rs 2 lakhs is not required to pay any Income Tax;

- A Sole Proprietorship Firm requires only one individual;

- There is no Minimum Capital Requirement for registering a Sole Proprietorship Firm;

Reasons to Choose a Sole Proprietorship Firm

The reasons for choosing a Sole Proprietorship Firm are as follows:

- Provides Ease in carrying out the business operations;

- One of the oldest, most accessible, and straightforward forms of business structures;

- Offers Single hand control;

- Flexibility to start and close;

- Requires very Few Compliances;

- Self-Accountability;

- Owner is solely liable for business affairs;

- Provides Decision-Making Power;

- No need to Share any Profit or Loss with anyone;

- No chance of any future dispute;

Things to Consider While Starting a Sole Partnership in India

The things to consider while starting a Sole Proprietorship in India are as follows:

- Choose a Unique Name for Business;

- Choose a Unique Location as the Place of carrying out business activities;

Documents Required for Sole Proprietorship Firm Registration

The documents needed for obtaining Sole Proprietorship Registration are as follows:

- PAN Card;

- Aadhar Card;

- Bank Account;

- Registered Address Proof;

- Certificate or License issued by the Municipal Authorities;

- CST (Central Sales Tax) Certificate;

- VAT (Value Added Tax) Certificate;

- Income Tax Returns;

- Certificate issued by the Food and Drug Control Authorities (FDCA), Indian Medical Council;

- Import Export Code;

- Utility bills in the form Landline Bill, Water Tax Bill, Electricity Bill, etc., issued in the name of the Proprietor;

Process of Sole Proprietorship Registration in India

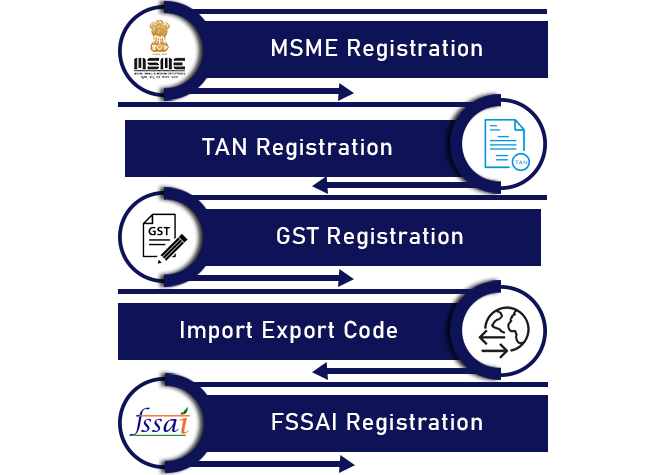

A Sole Proprietorship is an amalgamation of several registration and license. Further, some of the licenses that are required for the purpose of registration are as follows:

MSME Registration

The applicant needs to acquire both MSME and Udyog Aadhar Registration to get his/ her sole proprietorship business registered under MSME (Micro Small and Medium Enterprises).

TAN Registration

Every applicant needs to obtain a TAN (Tax Deduction Account Number) Registration from the IT Department. However, the said registration is needed only if the sole proprietor is making salary outflows in which TDS deduction is required.

GST Registration

Every Sole Proprietor needs to obtain GST Registration for his/ her business if the annual turnover exceeds the prescribed limit for registration. Further, the term “annual turnover” denotes the limit Rs 40 lakhs. However, the same is Rs 20 lakhs for some states.

Import Export Code

If a proprietor wishes to reach the global platform by dealing in imports and exports, then he/ she needs to obtain Import Export Code (IEC) from the DGFT (Director General of Foreign Trade) in the business name.

FSSAI Registration

If a sole proprietor wants to start a business of selling food products or want to deal in food products, then he/ she needs to acquire FSSAI Registration from the FSSAI.

Post-registration Compliances For Sole Proprietorship

The Post-registration Compliances for a Sole Proprietorship Firm are as follows:

- Filing of TDS (Tax Deducted at Source);

- Filing of ITR (Income Tax Return);

- GST Compliances;

- Drafting of the Financial Statements;

- Tax Audit Compliances;

- Documentation of the Sale and Purchase Invoices;

BIZ Process

Free Legal Advice

Transparent Pricing

On Time Delivery

Expert Team

Money Back Guarantee

200+ CA/CS Assisted

Lowest Fees

Easy EMIs

Frequently Asked Questions

No, there is no need to obtain registration for a Sole Proprietorship Firm in India. Also, the same is completely discretionary and depends on the choice of the Sole Proprietor.

Yes, it is necessary for every owner of a Sole Proprietorship Firm to acquire GST Registration in cases where the annual turnover exceeds the specified threshold of Rs 40 lakhs and Rs 20 lakhs.

9559179325

9559179325 9559179325

9559179325 9559179325

9559179325