Overview of Payment Gateway License

As we all know, online shopping has grown in popularity in India thanks to the convenience and flexibility it provides. A financial service supplied by an e-commerce application service provider is known as a Payment Gateway. To start a Payment Gateway service in India, however, a Payment Gateway License must be obtained from the Reserve Bank of India.

This digital platform not only allows you to purchase, but it also allows you to pay bills and recharge your phone. Over time, the same has evolved to include an online component.

It should also be mentioned that whenever a person makes an online purchase or pays a bill, he or she selects the option ‘Pay Now' and is sent to a new page. The Payment Gateway Website is the page to which that user is redirected, and it is used to make payments for goods and services acquired.

Concept of Payment Gateway

The word Payment Gateway refers to an intermediary that acts as a link between a website and the banks to facilitate transaction communication. That is, it obtains information from the buyer bank and transmits the identical transaction information to the receiving bank, after which it records feedback on whether the transaction was properly accepted or rejected.

License for Starting Payment Gateway Business in India

Section 4 of the Payment and Settlement System Act 2007 states that no one other than the Reserve Bank of India can operate or launch a payment mechanism. In addition, if an individual or a corporate organisation want to begin the process, they must submit an application for authorisation to the Apex Bank. The provisions of section 5 of the PSS Act 2007 must be followed.

Laws Governing Payment Gateway License in India

In India, there are laws that govern payment gateway licences. The Payment and Settlement System Act, 2007 (PSS Act) was enacted primarily to allow the Reserve Bank of India to control and supervise the payments system and procedures in India. For the purposes and any incidental matters that fall within the scope of this Act, the same shall serve as the principal regulatory authority.

Furthermore, the Reserve Bank of India has promulgated two regulations under this Act, namely:

Board for Regulation & Supervision of Payment & Settlements System Regulations, 2008

The Board for Regulation and Supervision of the Payment and Settlement System, as well as a Committee of the RBI's Central Board of Directors, are both governed by this regulation.

Payment & Settlements System Regulations, 2008

The same addresses all issues, including the application for authorisation to begin a payment system, the issuance of such authorization, payment instructions, payment standards to be maintained in the payment system, timely filing of required papers and financial information, and so on.

Advantages of Getting a Payment Gateway License

The following are some of the advantages of obtaining a Payment Gateway License:

PCI-DSS Wallet

The PCI – DSS Wallet compliance ensures the protection of the application's users' personal information in the portal or gateway for

recurring payments.

For example, a typical Amazon customer can save his or her bank account information on the app or on the company's official website,

and the gateway protects the information from cyber security threats.

White Label Wallet

It's worth noting that some payment gateways allow clients to conduct digital transactions through mobile wallet apps.

It is the most recent trend since it allows customers to conduct all of their operations and transactions from a single location.

Furthermore, the money can be simply transferred from a bank account to a mobile wallet application,

which can then be used to make payments on other mobile apps or websites.

Fraud Screening Tools

Some payment gateways provide FST (Fraud Screening Tools) to their customers in order to reduce the danger of personal data being lost.

The CCV (Card Code Value), AVS (Address Verification Service), are all examples of fraud screening tools (Card Verification Value).

It should also be mentioned that the major goal of these tools is to ensure that no fraudulent transactions are taking place.

Another key advantage of a payment gateway is that it allows for simultaneous transactions and deals from multiple users. This makes it possible for a consumer

to buy and sell goods and services anytime he or she want.

In India, how does a payment gateway work?

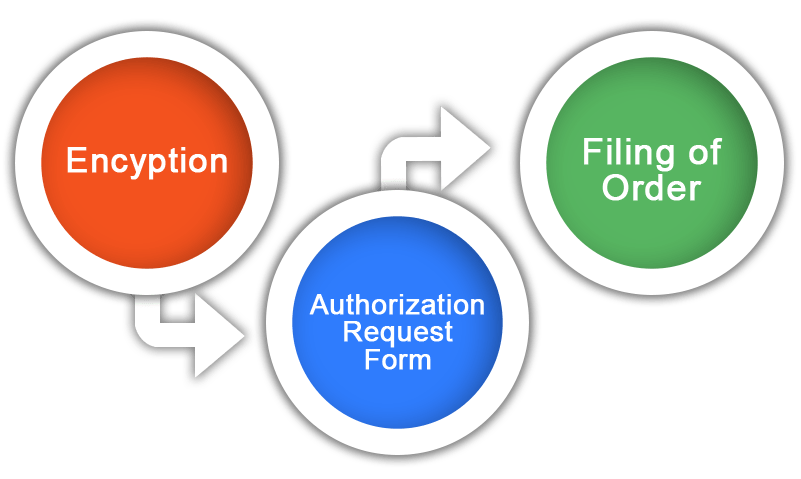

After a customer places an order on an online website, the Payment Gateway performs a number of actions, which are detailed below:

Encryption

In the first phase, the user's browser encrypts the data before sending it to the appropriate vendor's server. The payment gateway subsequently sends the transaction data to the payment processor that was designated.

Authorization Request Form

TOnce the payment processor has properly received the data, it sends it to the appropriate card association.

In addition, the bank that provided the payment card examines the transaction at this point and either denies or approves it.

The Order is being filed

If the relevant bank approves the transaction, the authorization for both the customer and the merchant is then transferred to the

Payment Gateway's main processor.

After receiving the response from the main processor, the information is forwarded to the portal for payment processing.

The information and data are analysed and the payment is made in this manner. The entire payment procedure takes only a few seconds to complete.

Payment Gateways Provide Additional Services

Payment Gateways provide the following extra services in addition to the ability to make rapid payments:

- Verification of the delivery address;

- Advanced Visual System Checks;

- Computer Finger Printing Technology;

- Velocity Pattern Analysis;

- Detection of Identity Morphing;

- Calculation of the Tax for Authorization of Request transmitted to the relevant Processor.

Payment Gateway's Major Components

The following are the main components of a Payment Gateway:

Agreement with a Merchant

The word "merchant agreement" refers to a contract between a company and its payment service provider. Furthermore, in relation to the acceptance of payment, authorisation, processing, and settlement, each of the parties involved in online transactions is guided by the prescribed roles, duties, and norms that have been stated under this agreement.

Electronic Transactions that are Safe

Secured Electronic Transactions (SET) are supplied by the major electronic transaction payment providers, such as Visa and MasterCard.

Furthermore, clients who are protected by SET benefit from the fact that it allows merchants to cross-check payment information without

actually viewing it. In addition, the card issuer receives the information and details listed on the card right away for the purpose of

verification.

Payment Gateway License Basic Requirements

The following are the essential conditions for obtaining a Payment Gateway License in India:

- The business or company in question must be formed under the Companies Act 2013 or the Companies Act 1956.

- A minimum of two people is required.

- A minimum of two directors are required.

- Proof of Business Address.

- Business Plan for the Next 5 Years

- The company's PAN.

- The company's current bank account information.

- The Software Certifying Agency's Report on System Flow and Code Testing.

- Registration Number for Service Tax.

- PCI DSS (Payment Card Industry Data Security Standard) compliance.

Payment Gateway License Capital Requirements

The following are the capital requirements for a Payment Gateway License in India:

- It should be emphasised that only non-banking financial companies (NBFCs) and schedule banks are required to meet the Reserve Bank of India's capital adequacy requirements. Also, only these entities will be allowed to issue prepaid payment instruments.

- All entities that are authorised to issue foreign exchange PPIs (Prepaid Payment Instruments) under the terms of the Foreign Exchange Management Act 1999 (FEMA) are exempt from the RBI recommendations.Furthermore, the use of such instruments will be limited to permitted current account dealing and transactions, and they will be subject to the restrictions imposed by the Foreign Exchange Management (Current Account Transactions) Rules 2000, as amended from time to time.

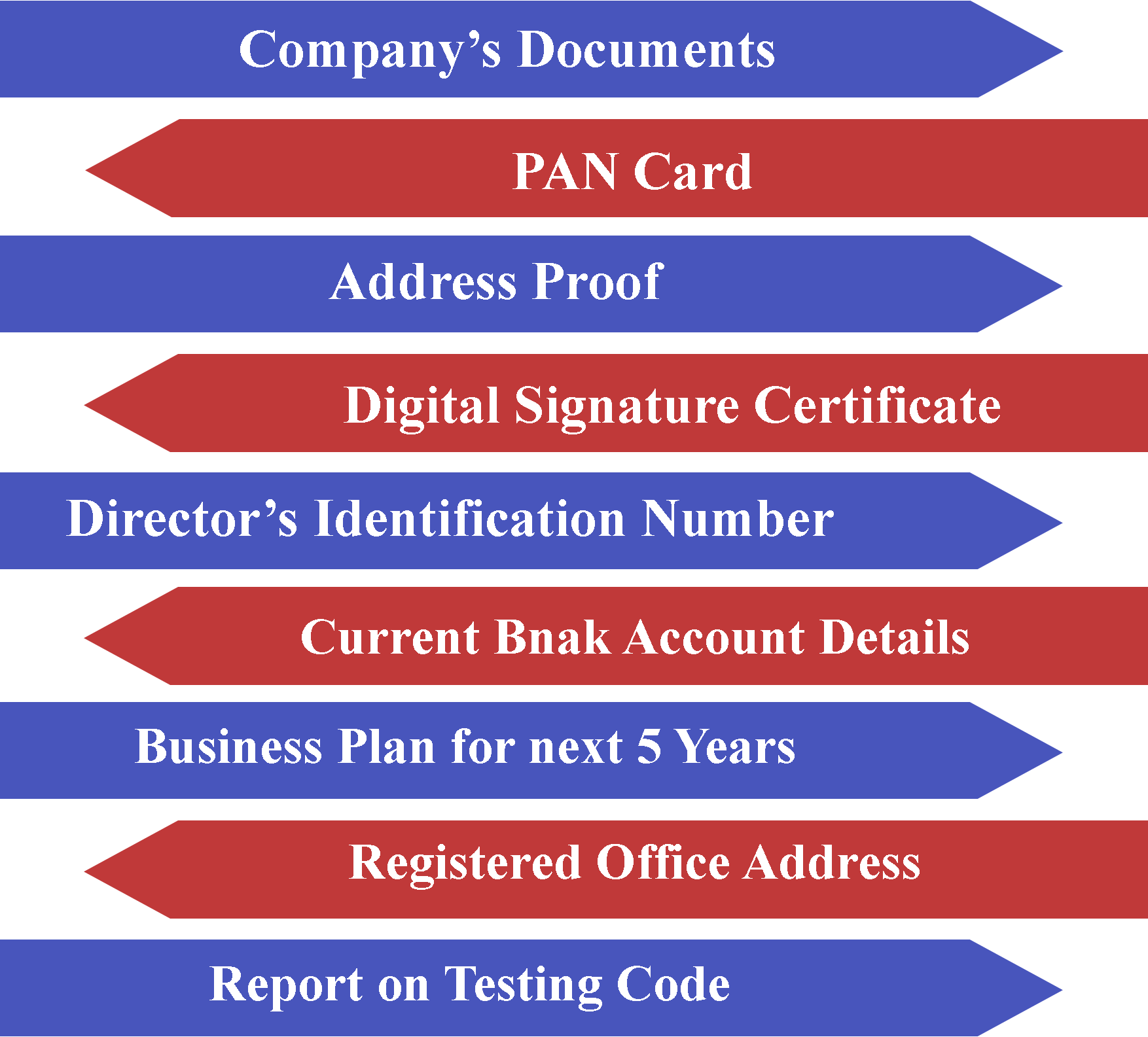

Documents required to get Payment Gateway License in India

The following are the documents required to obtain a Payment Gateway License in India

- A copy of the Registrar of Companies' (ROC) Certificate of Incorporation (COI) issued to the Company;

- Directors' PAN Card information.

- The Directors' Address Proof

- The Directors' Digital Signature Certificate (DSC).

- The Directors' Director Identification Number (DIN).

- Proof of the Registered Office's Address.

- Detailed information about the company's current bank account.

- The Company's Business Plan for the Next Five Financial Years.

- A Software Agency's report on the Testing Code.

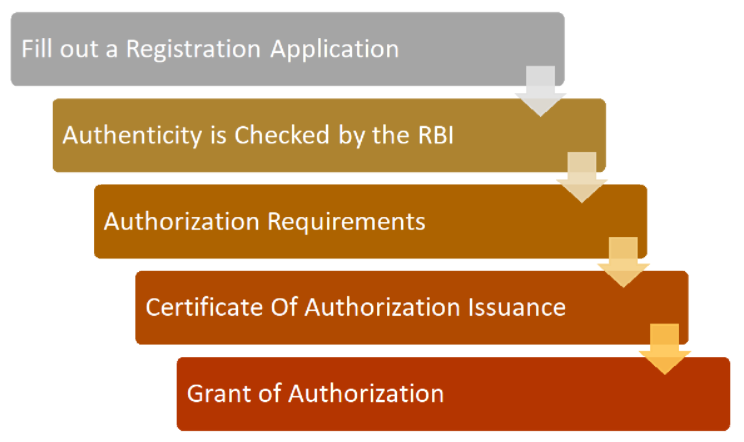

Registration Procedure for Obtaining Payment Gateway License in India

The following are the steps in the Registration Procedure for acquiring a Payment Gateway License in India:

Fill out a registration application

The first stage is for the applicant to submit an authorization application in the required Form A. The same is done in accordance with section 5(1) of the PSS Act.

Furthermore, the aforementioned application shall be sent to the "Chief General Manager" of the "Department of Payment & Settlement Systems" at the Reserve Bank of India's Central Offices in Mumbai, or to other RBI offices as mandated by it from time to time.

Authenticity is checked by the RBI

Obtaining RBI permission for the issuing of the authorization is discretionary under section 6 of the Payment and Settlement System Act 2007.

Furthermore, the Reserve Bank of India (RBI) has the ability to conduct whatever investigations it deems necessary to satisfy itself as to the legitimacy of the details and information provided by the applicant, as well as to verify the credentials of the relevant parties.

Authorization Requirements must be Met

Prior to issue the authorization, the Reserve Bank of India will consider the following conditions:

- The requirement of the proposal payment system or the services that it has stated it will provide.

- All technical specifications for the payment method or the structure of the chosen payment system that have been decided.

- The terms and circumstances for the proposed payment system's operation, including the security method.

- The mechanism by which the assignment is completed in the payment system given. The manner in which payment instructions are received will have an impact on the payment system's payment conditions.

- The overall management's financial situation, experience, and the applicant's integrity.

- The terms and conditions that govern and regulate the customer's relationship with the payment provider.

- Monetary and credit policies.

- Authorization time frame.

Certificate of Authorization Issuance

If the Reserve Bank of India (RBI) is satisfied that all of the requirements of section 7(1) have been met, it may give the applicant an Authorization Certificate in Form ‘B' for the establishment and operation of a payment system.Furthermore, the RBI's authorisation will take effect on the date specified by the RBI and subject to the criteria set by the RBI.

Within 6 months, authorization will be granted

According to section 4 of the Payment and Settlement System Act 2007, the Reserve Bank of India is required to process the application for authorisation as soon as possible, with a maximum time limit of six months, starting from the day on which the application was filed.

IT Requirements for Obtaining Payment Gateway License in India

The following are the various IT requirements for obtaining a Payment Gateway License in India:

- Governance of information security.

- Standards for Data Security

- Reporting of Security Incidents.

- Onboarding of merchants.

- Reports and audits on cyber security.

- Staff Competency, Risk Assessment of Vendors

- Roadmap & Maturity

- Requirement for cryptography.

- Data Sovereignty is a term that refers to the ownership of data.

- Outsourcing Data Security

- Application Security for Payments.

Why Choose Us

Free Legal Advice

Transparent Pricing

On Time Delivery

Expert Team

Money Back Guarantee

200+ CA/CS Assisted

Lowest Fees

Easy EMIs

Frequently Asked Questions

Payment Gateways serve as a link between banks and websites, facilitating the sending of transaction reports.

Debit/credit card numbers, online banking ids, and passwords, among other sensitive information, must be protected from fraud and misrepresentation. As a result, card associations have established security standards that must be fulfilled by everyone who has access to card information, such as payment gateways, as well as different rules and regulations.

9559179325

9559179325 9559179325

9559179325 9559179325

9559179325