Overview of NBFC Account Aggregator License

It's vital to understand the term "Account Aggregator" before proceeding to the NBFC Account Aggregator permit. Account Aggregators are components that enable financial information sharing across financial institutions in addition to maintaining a record and obtaining consent. Assent can be revoked and monitored in this way. They transfer money-related data from a financial data source to a financial data user.

Let Us Clarify the Importance of Both Terms for Your Better Understanding:

FIP (Financial Information Provider): A substance that provides money-related services in the budgetary domain.

Financial Information User (FIU): A component regulated by financial sector authorities such as RBI, SEBI, IRDA, and PFRDA.

The monetary data that will be transmitted is defined by the RBI's DNBR (Department of Non-Banking Regulation) master directives.

The Financial Information Has Been Defined by Master Directions As:

The following information is included in financial data:

- Deposits in non-banking financial institutions (NBFCs).

- Product with a Structured Investment (SIP).

- Paper for Business (CP).

- Deposit certificates (CDs) (CD).

- Securities issued by the government (Tradable).

- Equity Participation.

- Debentures are a type of bond.

- Mutual Funds are a type of investment vehicle.

- ETFs (Exchange Traded Funds) are a type of mutual fund that

- Receipts from the Indian Depository.

- Schemes of Collective Investment (CIS).

- AIF stands for Alternative Investment Fund.

- Policies of Insurance.

What is an NBFC Account Aggregator, and how does it work?

NBFC Account Aggregator is a type of device that acts as an assent agent, allowing financial institutions to share financial information in the financial sector. However, the information must be relocated with the client's permission. The Reserve Bank of India (RBI) came up with the idea in 2015. RBI has issued master directives for Non-Banking Finance Companies - Account Aggregators (NBFC-AA).

The NBFC-AA (NBFC Account Aggregator) is a budgetary component that is involved in the process of providing data to NBFC clients who have accounts with many NBFCs.

Such information will be grouped and organized. The information will be linked to the customer's financial interaction with NBFC's various products.

What are NBFC Account Aggregators, and what do they do?

The NBFC Account Aggregator is a financial institution that acts as an Account Aggregator for the NBFC's customers. Customers who have multiple accounts in different NBFC firms might use NBFC-AA to get information about them. Customer account information will be in the form of aggregated, organized, and retrievable data that will indicate the customer's financial involvement in various NBFC products such as mutual funds and insurance, among others.

Manager of Consent for Financial Data Transfer

NBFC-AA would provide consumers with a platform on which they may make data payments or transfer financial data from their numerous accounts to any company that wants access to it (FIU). The user's consent request can be started by sending the user a request for the appropriate financial information via the NBFC-AA Identifier. Following receipt of the request, NBFC-AA will guarantee that the requested information is shared when the user's approval is received via the NBFC-AA app. This is somewhat similar to a collect request authorization in a UPI (Unified Payment Interface) application.

FIU's data can be used to provide a variety of services to its consumers, including credit, personal financial services, wealth management advice, investment offers, and even future financial services like Robo banking, which is powered by artificial intelligence.

Users who register their accounts with NBFC-A have complete control over permitting or cancelling the sharing of data from their accounts in any FIP. Users can also choose whether or not they want their data to be exported in an organized format.

NBFC-AA (NBFC Account Aggregator) License Importance

The NBFC-primary AA's function is to provide information about clients' accounts. Information is stored in a way that is organized, consolidated, and retrievable. It is entirely up to the consumer whether or not to use the account aggregator's services.

The NBFC-AA engages in IT-related activities, which means that customers will receive digital data. NBFC-AA's function is account aggregation; as a result, unlike other NBFCs, they will not engage in financial asset transactions with their customers. An aggregator is allowed to invest investable surplus in instruments rather than trading them.

The NBFC (NBFC AA's Account Aggregator) services must be protected by proper agreements between the aggregator, the consumer, and the financial service provider. NBFC-AA (NBFC Account Aggregator) must adhere to the license's terms and conditions, which include consumer protection, grievance resolution, data security, corporate governance, audit control, and risk management framework. NBFC-AA is a concept proposed by the Financial Stability and Development Council (FSDC).

NBFC-AA (NBFC Account Aggregator) gathers information about a customer's financial assets and presents it to them in a consolidated, organized, and retrievable format.

Advantages of using an NBFC Account Aggregator

The Advantages of using NBFC Account Aggregator are as follows-

- The main purpose of the NBFC-Account Aggregator is to provide information about clients' accounts. Data is stored in a fashion that allows it to be sorted, merged, and retrieved. It is entirely deliberate for a customer to use the account aggregator's services.

- The NBFC-AA engages in IT-related activities, implying that clients will receive advanced information. NBFC-AA (NBFC Account Aggregator principal)'s function is account collecting; unlike other NBFCs, they will not engage in monetary resource exchange with its consumers. It is permissible for an aggregator to transfer investible surplus in instruments rather than for swapping. The estimation of administrations will be decided by a board-approved approach of the record aggregator. The account aggregator's guidelines and strategy must be transparent and accessible in the public domain.

- The NBFC (NBFC AA's Account Aggregator) administrations must be based on appropriate understandings between the aggregator, the client, and the financial service provider. The terms and conditions of the permit, such as client insurance, complaint resolution, data security, corporate governance, audit control, and risk management framework, must be followed by NBFC-AA (NBFC Account Aggregator). The option of NBFC-AA is accompanied by the Financial Stability and Development Council (FSDC).

- NBFC-AA (NBFC Account Aggregator) collects information about a client's financial resources and presents it to them in a combined, sorted, and retrievable format. The RBI has created a set of guidelines that must be followed by these drugs.

NBFC-AA Registration Requirements

- A minimum of Rs. 2 crores are required for an NBFC-AA (NBFC Account Aggregator) licence. Nonetheless, after receiving RBI's in-principal permission, the organization will have a year to raise funds. Other than account aggregation via NBFC-AA, no other services can be provided (NBFC Account Aggregator).

- Following the regulator's in-principal clearance, NBFC-AA (NBFC Account Aggregator) will have a year to set up all of the necessary innovation and bind ups in order to do this aggregation activity.

- According to the RBI, an entity that engages in the aggregation of accounts in a certain money-related sector handled by various controllers is exempt from obtaining RBI clearance. The NBFC-AA is directed by the RBI (NBFC Account Aggregator). Like other NBFCs, these elements are not permitted to carry out money-related activities.

- NBFC-AA will provide financial users with information about the client. They do not have the same qualifications as other NBFCs when it comes to fund-related activities. We can't really classify them as NBFCs at first glance. The data of the clients' monetary resources cannot be used by NBFC Account Aggregators for any other purpose.

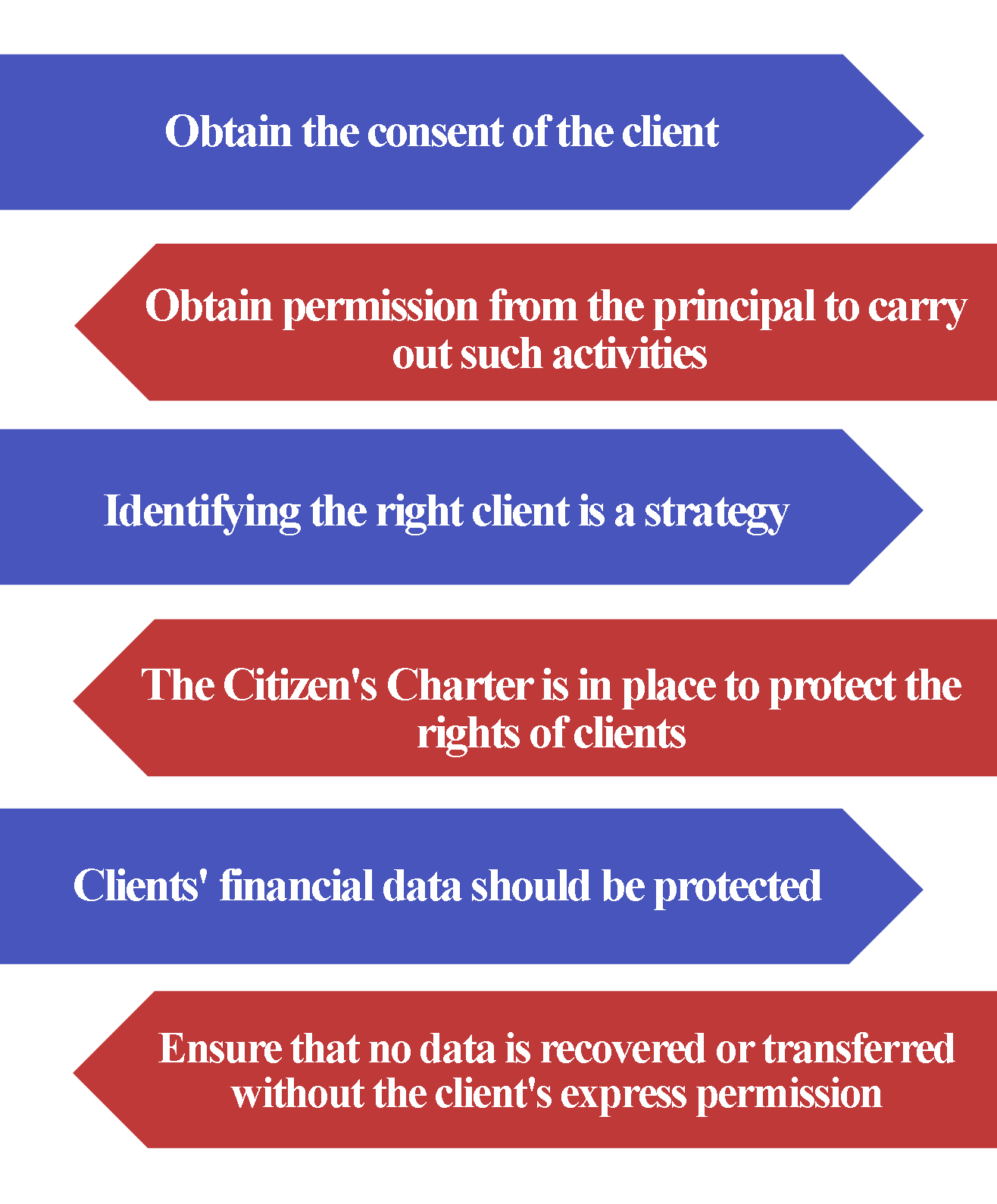

NBFC Account Aggregators' Duties and Responsibilities

The primary responsibility of the NBFC-AAs is to collect and disseminate data from any client who has given their explicit consent.

According to the RBI's instructions, the following are the NBFC-AAs' (NBFC Account Aggregators) responsibilities and duties:

- Obtain the consent of the client.

- Obtain permission from the principal to carry out such activities.

- Identifying the right client is a strategy.

- The Citizen's Charter is in place to protect the rights of clients.

- Clients' financial data should be protected.

- Ensure that no data is recovered or transferred without the client's express permission.

Promoters must meet RBI's fit-in criteria.

- Create a technique for determining the promoters' fit and relevant criteria.

- The strategy will be entirely based on the RBI's guidelines.

- According to the organization's orders, a statement will be requested from the directors/managing directors/CEO.

- The directors/managing directors/CEO will get an agreement deed in accordance with the organization's instructions.

- Within 15 days after the close of the financial year, provide a yearly explanation on changes of directors/managing director/CEO that has been properly verified by the Statutory Auditors in terms of fit and legitimate criteria.

NBFC Account Aggregator Registration Process

The RBI's master directions are followed for registering an NBFC-AA. This type of material will not have any sort of public funding or client contact.

The Following Steps Should Be Followed For NBFC-AA (NBFC Account Aggregator) Registration:

- The first step is to register your company under the Companies Act of 2013.

- To provide such services, the company must have the necessary assets.

- To address the issue of account aggregator, the organization devised an appropriate capital structure strategy.

- The administration's overall personality isn't tainted by public scandal.

- It is necessary to obtain a Certificate of Registration (CoR) from the RBI in order to conduct account aggregator activities.

- The candidate must submit an application to the RBI in order to get a Certificate of Registration (CoR).

- A minimum investment of Rs. 2 crore is required.

- To conduct account aggregation services, it is equipped with a data innovation framework.

- The NBFC-AA promoters must be healthy and legitimate.

What should the NBFC-AA (NBFC Account Aggregator) do during the in principal approval validity period?

During the legitimacy stage, the firm will design for a data innovation platform and complete all necessary legal papers to conduct business.

NBFC-CoR AA's may be revoked by the RBI due to non-compliance:

- If the organization ceases to conduct record gathering activities; if the organization refuses to accept the conditions under which the RBI issued the certificate of registration.

- If it is revealed that NBFC-AA (Non-Banking Financial Company-Account Aggregator) is not competent to hold the certificate of registration, the certificate of registration will be revoked.

- RBI has given instructions.

- Taking care of accounting.

- Distribute and reveal its financial condition in accordance with the law.

- Accountancy books are being investigated.

NBFC-Data AA's Security Norms

Because they transport a lot of financial data from diverse clients, NBFC-AA must have a legal IT infrastructure. These elements will be solely responsible for the secure storage and transfer of information from financial data providers to budgetary data clients. They'd also have to make sure that customer passwords couldn't be recovered or stored in their system.

- Protection against unauthorized access, modification, destruction, disclosure, or dissemination of records and data.

- To store financial data, use the appropriate innovation stage.

- Take critical efforts to mitigate the danger.

- External CISA-certified auditor audits the data system.

As we would like to believe, the RBI's decision to direct such aspects is a wise one. The Reserve Bank of India (RBI) issued NBFC Account Aggregators Rules in 2016 to address this. Though it is not appropriate to refer to them as NBFCs because they do not engage in any type of financial activity.

Revocation of Certificate of Registration of NBFC-AA.

RBI-DNBR has the authority to revoke the Account Aggregator's Certificate of Registration if any of the following requirements are met:

- In India, the company ceases to operate as an Account Aggregator.

- The Company has failed to meet any of the requirements for which the Certificate of Registration as an Account Aggregator was issued.

- The Company looks to be ineligible to possess the Certificate of Registration, according to the Bank.

- The Company violates any of the conditions that must be met in order to get a Certificate of Registration.

The firm fails to:

- Follow RBI's instructions.

- Accounts must be kept, information must be published, and financial information must be disclosed as directed by the Bank or as required by law.

- Submit its books of accounts or other relevant documents for scrutiny to the Bank.

Why Choose Us

Free Legal Advice

Transparent Pricing

On Time Delivery

Expert Team

Money Back Guarantee

200+ CA/CS Assisted

Lowest Fees

Easy EMIs

Frequently Asked Questions

NBFC Account Aggregators are regulated by the Reserve Bank of India (RBI).

9559179325

9559179325 9559179325

9559179325 9559179325

9559179325