Overview of Merger & Acquisition

Mergers and acquisitions strategies are used by organizations all over the world to succeed in this competitive economic environment. Mergers and Acquisitions (M&A) is an acronym for mergers and acquisitions.

A merger is described as the joining of two or more companies to form a larger entity. One company will go out of business, while the other will absorb the former. For instance, if Company A and Company B merge to become a larger Company A, Company B ceases to exist.

On the other hand, acquisition is described as the process of selling one company to another. As an example, Company A buys Company B. Both of these companies exist, but Company A has management control over both of them.

In an amalgamation, both companies cease to exist, and a new corporation (with a new name) emerges. Firm A and B merge to produce a new company C and cease to exist as separate entities.

Reason behind Mergers and Acquisitions

Mergers and acquisitions are important tools that businesses use to expand their operations around the world and to ensure long-term growth. Following that, the cause for the widespread practise of mergers and acquisitions is discussed.

Mergers and acquisitions are the path that firms are taking these days to achieve exponential growth and continue to attract attention. The Indian Merger and Acquisition market works in a similar way, and there have been several significant M&A deals in the banking, insurance, and telecom industries in recent years. As a result, M&A has become an important aspect of the Indian economy throughout time.

Furthermore, this has been shown time and time again. M&A is sometimes confused with mergers and acquisitions since both terms refer to the merger or acquisition of two or more companies. In terms of implementation, however, they are diametrically opposed.

The term "merger" refers to the coming together of two or more businesses to form a new entity. Furthermore, the merger procedure is carried out with the goal of boosting corporate growth and expanding the company's goodwill and reach. Acquisition, on the other hand, is the act of an acquirer firm purchasing a target company through a legal agreement. Companies choose M&A for the following reasons:

- In order to reduce competition.

- For the purpose of gaining a larger market share.

- For the purpose of creating a strong brand name.

- For the purpose of reducing tax liabilities.

- For risk diversification.

- For balancing the losses of one organisation against the profits of another.

Merger and Acquisition Benefits

The following are some of the benefits of mergers and acquisitions:

Increased Dimensions

The M&A process aids corporations in boosting their net worth and operations, which would otherwise take years. Furthermore, these strategic tools aid in the increase of the company's stock price.

Competition is lessened

The newly created company's combined capital and reserves assist it in decreasing competition and achieving a competitive advantage.

Increased Strength

The synergy created by combining two or more companies is powerful enough to outperform other market participants, ensure greater performance, and generate financial gains, among other things. Additionally, it makes acquiring a wider consumer base easier.

Tax Benefits

It also gives a variety of tax benefits to the entities involved. The losses incurred by one entity are offset against the profits generated by another entity, lowering the tax burden.

Establishes a New Market

M&A improves sales chances because it brings two companies together. Aside from that, M&A can help a company expand its market reach.

Types of Mergers and Acquisitions in India

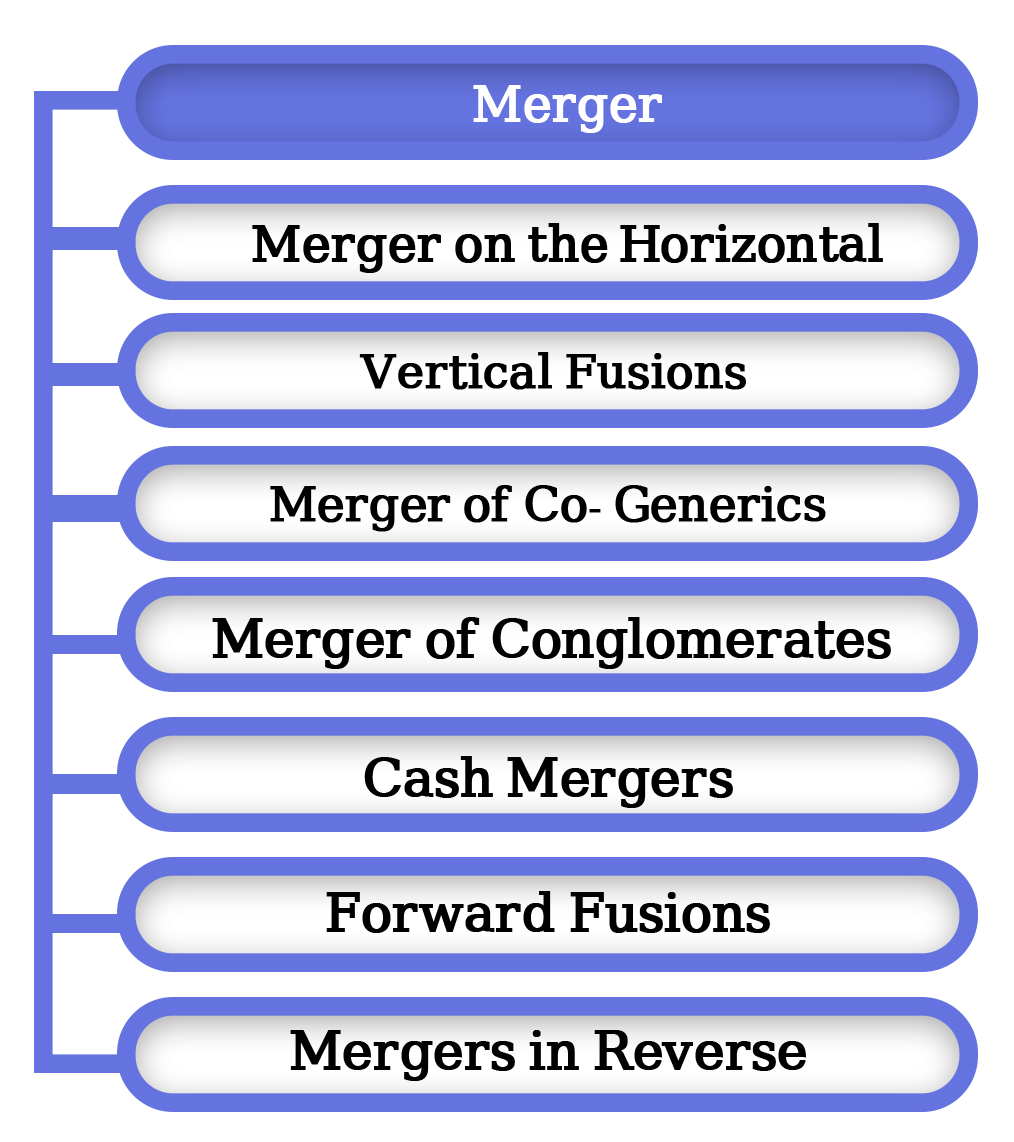

Mergers:

Merger on the Horizontal

A merger between two businesses that sell the same goods or services.

Vertical fusions

This form of merger occurs when two companies that deal in complimentary goods and services join forces.

Mergers of Co-Generics

A merger between two parties who are related in some way.

Mergers of Conglomerates

A merger between companies that operate in various industries.

Cash Mergers

A type of merger in which shareholders receive cash rather than shares in the amalgamated business.

Forward fusions

When a company decides to unite with its purchasers, it is called a merger.

Mergers in Reverse

When a company decides to merge with its raw material suppliers,

Acquisition

The acquisition, often known as a takeover, entails the sale and purchase of an entire firm between the parties involved. An acquisition can take place in a friendly or hostile environment.

There are two options for doing so. It can be accomplished by acquiring the target company's assets and liabilities or by purchasing the target company's stock.

Partnerships and Joint Ventures

When at least two companies come together for a specific cause – such as to enter a new market or business, or to develop a new capability - that association is known as a Joint Venture. It could be for a set period of time or for an indefinite period of time.

Mergers and Acquisitions Process in India

The Companies Act of 2013 defines the entire mergers and acquisitions process in India. The study of the firms is done throughout the mergers and acquisitions process, which includes accessing the company's information, reading over its insights, and coming to a decision on how to conduct the mergers and acquisitions process.

The successful and comprehensive execution of a mergers and acquisitions process comprises a technique that is organised to maximise profit while minimising risk.

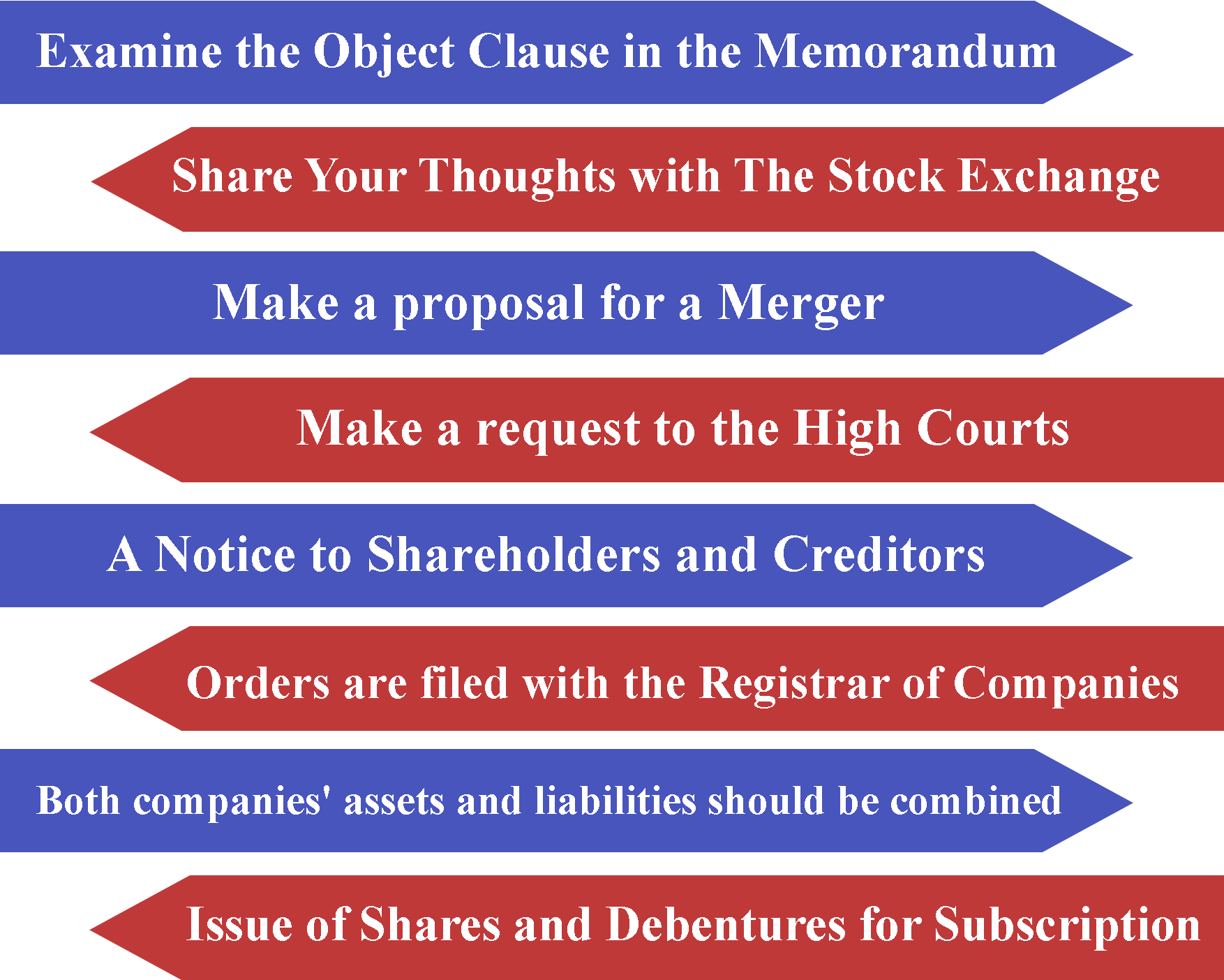

Steps to Take When Dealing with Mergers and Acquisitions in India

Examine the Object Clause in the Memorandum

When considering an M&A in India, the first and most important step is to review the company's memorandum of association in order to conduct a search and determine whether the merger authority is granted or not.

Share Your Thoughts with The Stock Exchange

It's a good idea to notify the stock exchange that a proposed merger and acquisition is taking place and to transmit any essential papers, such as notices, resolutions, and orders, to the stock exchange within a certain amount of time.

Make a proposal for a Merger

The Boards of Directors of both organisations will present an affirmation on the merger proposal's draught and also approve a resolution approving key administrative personnel and other administrators to take the matter further.

Make a request to the High Courts

Following the Board of Directors' approval of a plan, merger organisations should file an application with the Hon'ble High Court of the specific state where the organization's headquarters is located.

A Notice to Shareholders and Creditors

With the High Court's prior consent, a notice of the upcoming meeting should be delivered to all of the organisations' investors and creditors, with 21 days of timely notification necessary. The announcement will be delivered in two papers, one in the state's vernacular tongue and the other in English.

Orders are filed with the Registrar of Companies

Within the time frame specified by the High Court, the genuine confirmed copy of the request for the state's High Court must be documented with the registrar of companies.

Both companies' assets and liabilities should be combined

The assets and liabilities of both organisations should be transferred to the combined entity.

Issue of Shares and Debentures for Subscription

When the merging companies are registered as a separate legal entity, they can issue offers and debentures after being listed on the stock exchange.

M&A Advisory Services are Required

Mergers and acquisitions are a fantastic method for a company to grow, but they come with a lot of complicated stages and procedures that need to be followed by all parties involved in order to build the new company.

As a result, it is prudent to consult a specialist for mergers and acquisitions or to use mergers and acquisitions consulting services, as the method involves strict repercussions of laws and rules, which might cause problems in the future.

Various Mergers and Acquisitions consultancy firms guide their clients through this transformation process, which includes complex financial, legal, and accounting challenges.

Different Companies Offer Mergers and Acquisitions Services

- Investment banks that act as financial consultants to their clients. They have some experience in endorsing, as well as acting as brokers and providing mergers and acquisitions advice.

- Law offices - driving worldwide and local law offices to give M&A advisory services, particularly to cross-border company elements merging or acquiring.

- Audit and accounting firms are businesses that specialise in auditing, bookkeeping, and tax assessment. They provide specialised advice on M&A advisory firms' financial matters.

- Consulting and M&A Advisory Businesses — These firms provide dedicated M&A support, whether it's cross-industry or cross-border, because their group includes industry experts who can assist in determining the optimal M&A strategy.

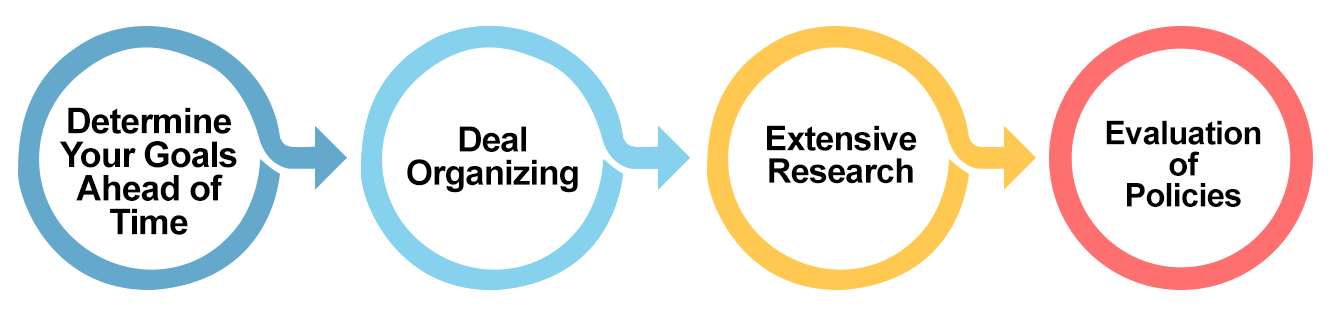

Before pursuing a merger or acquisition, there are a few things to think about

Before beginning the merger and acquisition process, keep the following in mind:

Determine your goals ahead of time

It is critical to pre-determine the Company's objectives in order to simplify the M&A process. Furthermore, it is vital to check whether the other organisation was successful in achieving the intended results on a timely basis.

Deal Organizing

It is the most important aspect of any M&A transaction. Both the acquirer and the target company must resolve all potential issues in advance, such as financial liabilities, deal price, asset sharing, and so on.

Extensive Research

Various forms of taxes are levied depending on the nature of the industry, all of which are subject to ongoing regulatory oversight. The acquiring company gets an understanding of the target company in terms of transfer pricing, ITR filing, and other tax liabilities by completing tax due diligence.

Evaluation of Policies

The acquirer company must review all of the target company's insurance policies relating to intellectual property, employee liability, and general liability to see if they are beneficial to the company.

Difference between Merger and Acquisition

Definition

Merger

Merger is the term for when two or more entities come together to work as one.

Acquisition

Acquisition refers to when one corporation takes over the control and management of another.

Terms

Merger

Mergers are always planned and completed with the parties' mutual consent.

Acquisition

Acquisition might be aggressive and involuntary at times.

Title

Merger

The merging company is given a new name.

Acquisition

The target company is not given a new name.

Scenario

Merger

Two or more companies that work in a similar way are more likely to merge.

Acquisition

It's important to remember that the target firm is always smaller than the acquiring company in terms of size, operations, growth, and market.

Authority

Merger

In terms of authority, both companies are equal.

Acquisition

The acquiring company oversees and monitors the target firm's operations.

Stocks

Merger

For the merging firm, new shares are issued.

Acquisition

For the purchased company, no new stock is issued.

Legal Formalities

Merger

Legal compliance is increasingly important during the merger process.

Acquisition

In the acquisition process, there are less legal compliances.

Purpose

Merger

The merger's primary goal is to reduce competition and improve operational competency.

Acquisition

The acquisition's primary goal is to gain immediate growth.

Example

Merger

Radiant Life and Max HealthCare have merged.

Acquisition

Tata Motors Private Ltd has purchased Jaguar Land Rover.

Why Choose Us

Free Legal Advice

Transparent Pricing

On Time Delivery

Expert Team

Money Back Guarantee

200+ CA/CS Assisted

Lowest Fees

Easy EMIs

Frequently Asked Questions

The phrase "acquisition" refers to the process of one corporation being taken over by another.

The term "cross-border mergers and acquisitions" refers to transactions in which the acquirer is based in one nation and the target is based in another.

9559179325

9559179325 9559179325

9559179325 9559179325

9559179325