Overview of Project Office Registration

It is critical for a corporation establishing a project office in India to do so with the intention of completing a certain project. India, as one of the world's fastest developing economies, has made strenuous attempts to become one of the best destinations to do business. As a result of this decision, the government has delegated some RBI authorities to AD Bank in order to make the project office establishment process more effective and transparent. Now, setting up a project office is as simple as doing business in India, and even non-residents can start up shop without difficulty.

The RBI permits a parent business based in another nation to register a project office in India to represent the interests of the parent firm when executing projects in India. To execute a project in India, however, the parent business must have a contractual agreement. Any Indian government or private sector organisation can award the project to a foreign company.

In addition, the project office can only participate in activities that are part of the project's scope and are carried out by the parent firm in India. The scope of the project also includes incidental and associated tasks.

The project office registration process is carried out in accordance with the criteria set forth in section 6(6) of the Foreign Exchange Management Act 1999.

The Reserve Bank of India has the ability to authorise the establishment of a project office in India by a foreign corporation. However, a foreign business must first acquire a contract with an Indian corporation before establishing a project office in India.

If a foreign firm intends to set up a project office in India, RBI guidelines and the Companies Act of 2013 have made it mandatory for the foreign company to obtain a registration certificate from the Registrar of Companies (ROC). During the project office registration process, it must follow all procedural formalities.

India's Investment Entry Points

Route of the Reserve Bank

A foreign company's core business fits under the requirements for which 100 percent Foreign Direct Investment (FDI) is permitted.

Route of the Government

The core business of a foreign entity meets the requirements for which 100 percent foreign direct investment is prohibited. Companies categorised as Foreign Non-Government Organizations, Non-Profit Organizations, Government Bodies, Departments are reviewed by the Reserve Bank of India in consultation with the Ministry of Finance of the Government of India.

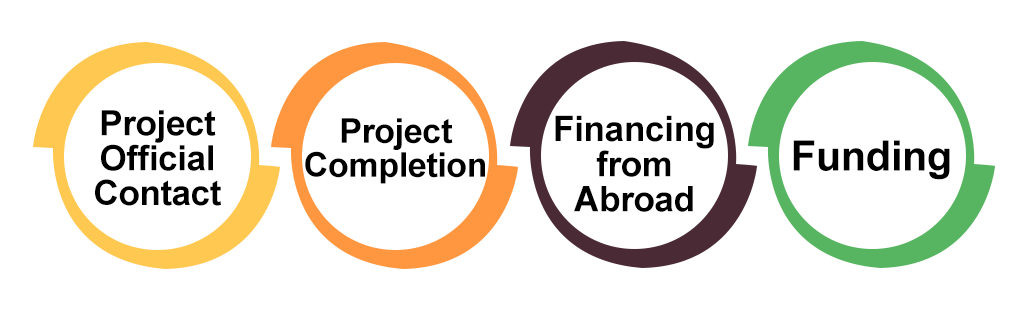

Requirement for Project Office Registration in India

In India, project office registration is required.

The Project's Official Contact

It is vital for a foreign company to have a secure project in India and to get into a written and legal agreement that will aid in the project's financial statement.

Project Com

pletion

Ascertain if the project has received approval from the proper and recognised authorities.

Financing from abroad

Ensure that the project is funded through inward remittances from the foreign country; otherwise, the project will need to be sponsored by an International Financing Agency.

Funding from India

When there is no foreign finance, the Indian entity is responsible for obtaining a term loan from a Public Financial Institution or a bank in India.

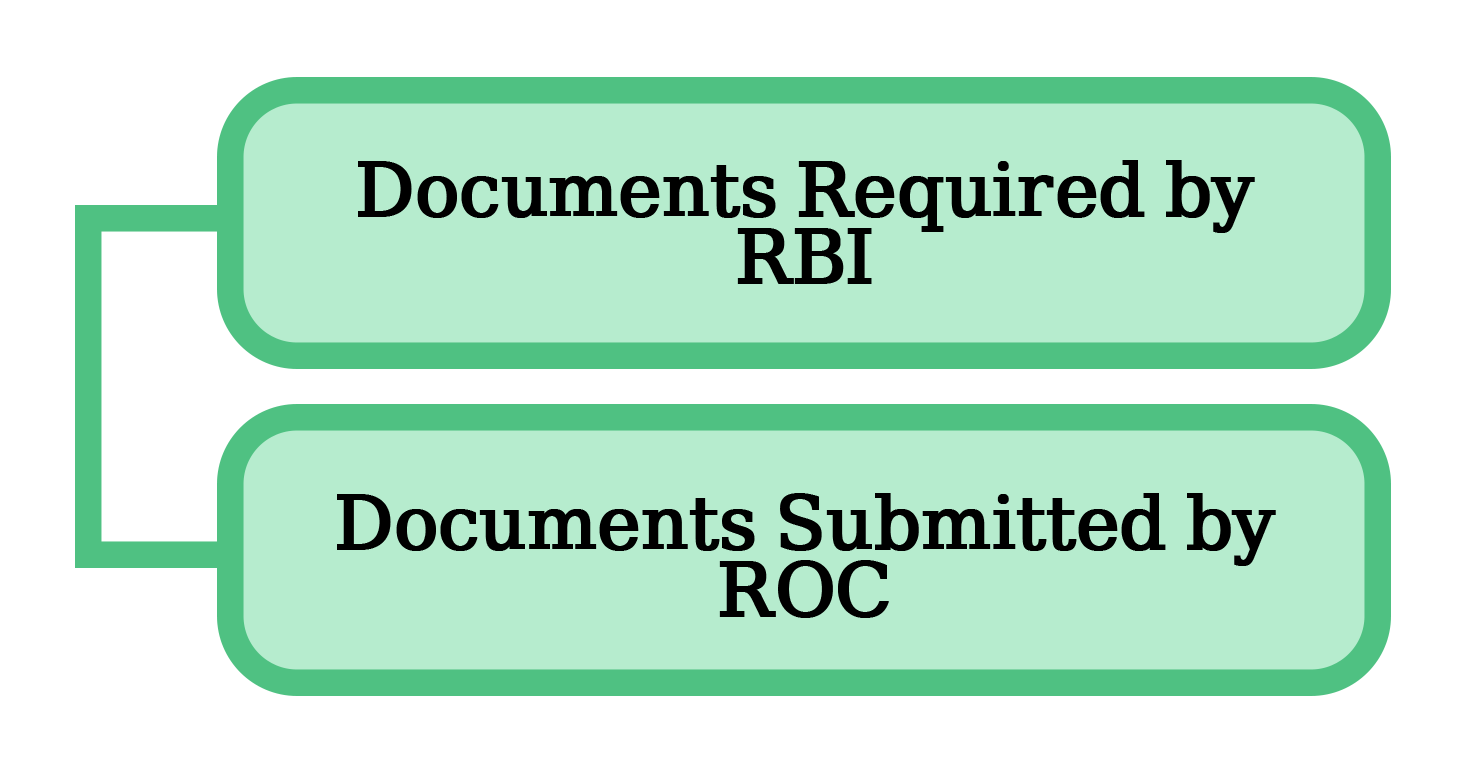

Documents Required for Project Office Registration in India

In India, certain documents are required for the registration of a project office.

Documents Submitted to the Reserve Bank of India

- Certificate of Incorporation.

- In the country of registration, the Memorandum of Association and Articles of Association must be attested by an Indian Embassy/Notary Public.

- Currently being audited The applicant's company's balance sheet.

- A decision from the board of directors of the foreign firm announcing the desire to open a project office in India.

- Documentation demonstrating that the Project Office is financially backed by bilateral or multilateral international financing agencies OR that the Indian Company has acquired a term loan for the Project Office from an Indian financing institution or bank.

- The company's banker submits a banker's report detailing the company's connection with the bank.

- In the case of the local representative, a letter of authority from the parent firm is required.

- Detailed information about the activities carried out in the project office in India.

- Authorized personnel's proof of residence.

- A copy of the authorised personnel's passport.

- The corporation will open a bank account in India, according to a letter.

Submitted Documents to the ROC

- The RBI has granted permission to open a project office in India.

- The Foreign Company's MOA and AOA

- A notarized copy of the COI is required.

- A notarized copy of a power of attorney naming the individual resident in India as the agent for the company and authorising him to accept any notice or document on the company's behalf.

- A comprehensive list of the company's directors

- Complete KYC of shareholders holding more than 10% of equity in the applicant company.

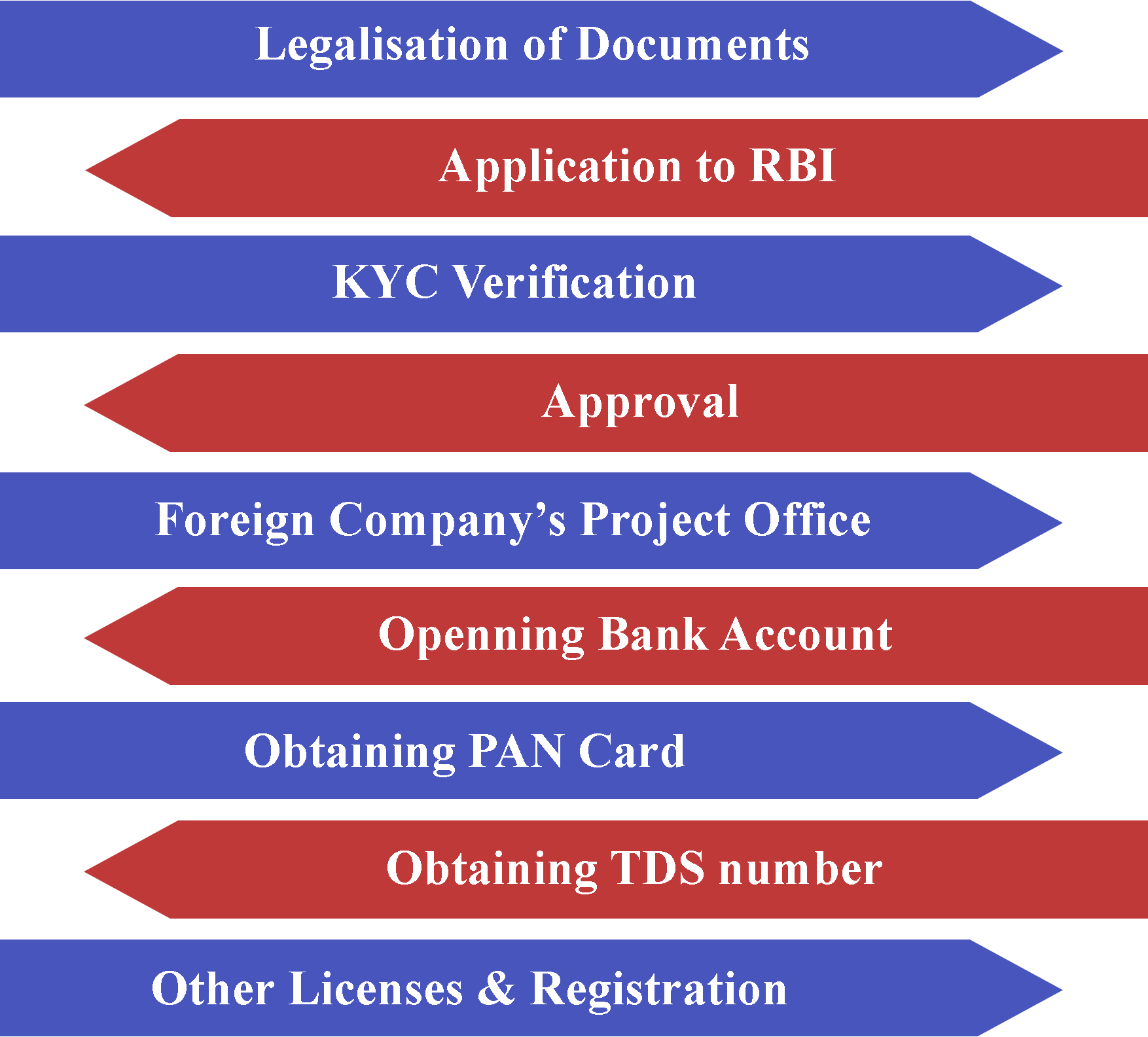

Project Office Registration Procedure

The step-by-step process for Project Office Registration are as follows-

Legalisation of Documents

It is important to file all of the foreign company's documentation with the RBI. A certificate of incorporation, the foreign company's MOA and AOA, and board decisions are among the documents on the list. Additionally, ensure that any documents signed by the authorised signatory of the foreign entity are legalised by the Indian Embassy or apostilled in accordance with the Hague Convention.

Application to the Reserve Bank of India by way of AD Bank

A foreign company's parent office application is filed with FNC. The application is submitted through AD Bank to the Reserve Bank of India (Authorised Dealer). The AD bank plays a crucial function because it is through them that all contact with the RBI is routed.

KYC verification from the parent company's banker

A request for document review is addressed to the banker of the foreign company. Swift-based verification refers to the procedure of making a request for verification. The application is preceded for approval purposes once the foreign banker has confirmed the materials. The RBI/AD may also request other documentation, depending on the circumstances.

The Reserve Bank of India has approved the registration of project offices in India

After the business is formed, the next stage is to open a bank account for it, where foreign direct investment shall be made within 180 days of the company's formation, with advance notice to the banker.

Registration of a foreign company's project office with the ROC

Within 30 days of receiving RBI clearance for the creation of the Project Office in India, an application for project office registration of the foreign firm is filed. If there is an Indian director, a DIN is necessary, as is the authorised signatory's digital signature for e-filing statutory papers with the ROC.

Opening a bank account, obtaining a PAN card, and obtaining a tax deduction number

PAN numbers are issued by India's income tax agency and are unique 10-digit numbers. The branch office can open a bank account once it has received its PAN number. To comply with all TDS regulations, every taxpayer must get a Tax Deduction Account Number.

Other Licenses and Registrations

Once the Project Office is decommissioned, several compliance actions are carried out based on the business genre and state-specific legislation that apply to all companies engaged in commercial activities. The Goods and Services Tax (GST), the Professional Tax Act, the Provident Funds Act, and the Employee State Insurance Act are just a few examples (ESIC).

Project Office Validity

The Project Office will be valid for the duration of the project (till the project is completed or wound up).

Important things to keep in mind

- Private companies based outside of India are not permitted to open a project office in India.

- The acquisition of any property by a foreign entity's project office is permitted for the purpose of carrying out activities that are permitted by the Reserve Bank of India or for their own use.

- A project office in India can only keep non-interest-bearing current accounts.

- The Registrar of Companies must be notified in writing of the opening of a project office in India, along with all necessary documentation, within the time frame given.

Project Office Accounts in Foreign Currency

- Project Offices are permitted to open non interest bearing foreign currency accounts with AD Category – I banks if the following conditions are met:

- The Project Office was formed in India in accordance with the relevant regulations.

- The project's contract specifies that payment will be made in foreign currency.

- Each PO can create two foreign currency accounts, one in USD and the other in the project awardee's home currency, but both must be maintained with the same AD Category–I bank.

- They can only be used to pay project-related expenses and receive foreign currency from the Project Sanctioning Authority, as well as remittances from parent/group companies in other countries or bilateral/multilateral international finance organisations.

- The entire obligation for ensuring that only approved debits and credits are permitted in the Foreign Currency Account is with the AD's branch in question. Furthermore, the Accounts will be thoroughly scrutinised by the appropriate AD banks' concurrent auditor.

- At the end of the project, the foreign currency accounts must be closed.

Remittance of Profit or Surplus

Project Office is allowed to remit project profit outside of India after deducting appropriate Indian taxes.

However, an authorised Dealer Category – I bank may allow project offices to make intermittent remittances while the project is being wound up or completed, subject to the provision of the following documents:

- The Project Office produces an Auditors' / Chartered Accountants' Certificate stating that adequate arrangements have been made to meet India's duties, such as Income Tax, etc.

- An assurance from the Project Office that the remittance will not jeopardise the project's completion in India, and that any shortage in finances for satisfying any liability in India will be made up with inward remittance from outside.

Funds must be transferred between projects with the consent of the Regional Office of the Reserve Bank under whose jurisdiction the Project Office is located.

Procedure for Closing of a Project Office

- The PO or their nodal office, as the case may be, may make requests for the closure of the PO and the payment of the PO's winding up revenues to the designated AD Category - I bank (AD Bank). The following documents must be submitted:

- Confirmation from the applicant/parent company that the PO is not the subject of any legal actions in India and that there is no legal barrier to the repatriation.

- The approved AD Bank must verify that each PO has submitted their Annual Activity Certificate (s).

- Any additional document/s required by the Reserve Bank of India or the AD Bank for clearance.

Copy of the Reserve Bank/AD Bank's approval for the PO to be established.

Auditor's certificate

1. Indicating the method by which the remittable amount was calculated, as well as a statement of the applicant's assets and liabilities, as well as the way in which assets were disposed of.

2. Confirming that all liabilities of the office in India, such as arrears of gratuity and other benefits to employees, have been met or appropriately provided for.

3. Confirming that no revenue earned outside of India (including export proceeds) has remained unrepatriated to India.

After acquiring copies of the sectoral regulators' consent to close, along with the documentation stated above, a designated AD Category-I bank may authorise remittance of winding up proceeds in respect of offices of banks and insurance companies.

Why Choose Us

Free Legal Advice

Transparent Pricing

On Time Delivery

Expert Team

Money Back Guarantee

200+ CA/CS Assisted

Lowest Fees

Easy EMIs

Frequently Asked Questions

If a project has been given to them by the government or the private sector, a foreign business is required to set up a project office in India, as long as the project is to be completed entirely in India. On a temporary or permanent basis, a foreign corporation can open a project office. Before beginning to conduct business, you must complete the RBI and ROC registration process. All of the required conditions must be met before the project office may be registered.

- The project's official contact,

- Clearance of Project.

- Foreign Funding.

- Indian Funding.

9559179325

9559179325 9559179325

9559179325 9559179325

9559179325