Overview of Branch Office Registration

A foreign corporation establishes a BRANCH office in India to carry out BRANCH activities for its business. The foreign firm can only generate revenue from the Indian Branch office if the Reserve Bank of India allows it; it must cover all of the expenses of the Indian office using remittances from the Head office or revenue generated from the Reserve Bank of India-approved Indian operation.

In India, foreign corporations are permitted to open a branch office. However, unlike forming a corporation, establishing a branch office necessitates clearance from the Reserve Bank of India (RBI). The foreign company can only begin operations after receiving a branch licence from the RBI.

BRANCH OFFICE is suitable for a foreign company to test and understand the Indian market with very strict control by the Reserve Bank of India, as it allows companies to do business but only for the activities listed in the Branch Office application. Any additional activity carried out by the Branch Office will be illegal.

India is one of the world's largest consumer marketplaces and the world's most powerful economies. The fact that India is a fast-growing emerging economy makes it an appealing investment and commercial venture location for companies from all over the world. As a result, we are seeing an increase in the number of foreign corporations registering branch offices in India. The goal of establishing such a branch is to broaden the company's business interests in India.

For the registration of a branch office, the Reserve Bank of India is the approval authority. Section 6(6) of the Foreign Exchange and Management Act 1999 governs the creation of a branch office. The RBI master directive also lays up the standards for governance, competitive authorities, and reporting obligations.

A foreign company's branch office registration allows it to function as a legitimate business entity in India. The branch office can conduct business in the same way that the parent company does in their home country.

Branch Office, on the other hand, is restricted when it comes to manufacturing activity. A branch office, for example, cannot conduct manufacturing activities directly but can subcontract them to an Indian company.

Branch Office Features in General

- The Indian branch office's name must be the same as the parent companies.

- Reserve Bank of India is the Governing body for the branch office License.

- It is suitable for foreign companies that want to open a temporary office in India but aren't interested in or planning long-term activities in India.

- If the head office does not have money from Indian operations, it covers all of the expenses of the Branch office.

- Expanding its customer base by expanding its operations to new locations.

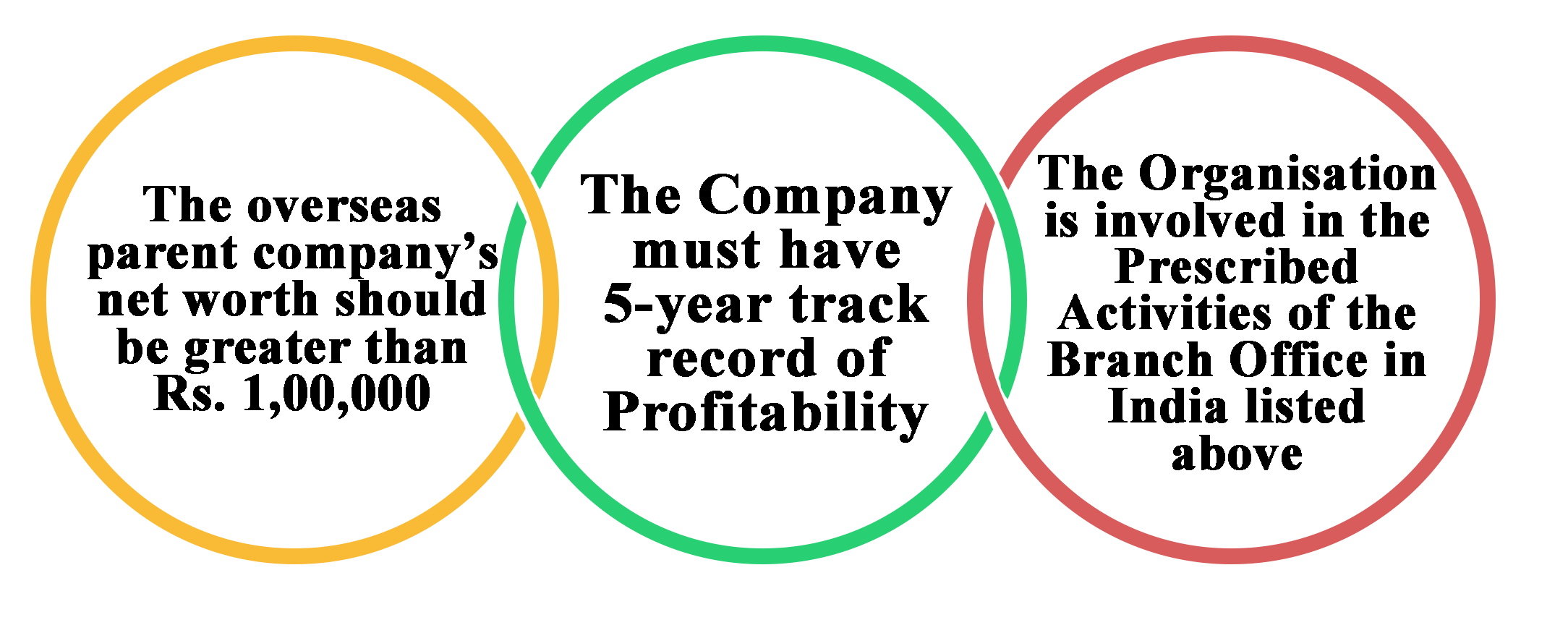

Eligibility Criteria to open a Branch Office in India

For a company to be eligible to open a branch office in India, it must meet the following criteria:

- The overseas parent company's net worth should be greater than $1,000,000.

- The company must have a five-year track record of profitability.

- The organisation is involved in the Prescribed Activities of The Branch Office In India listed above.

Activities that a Branch Office in India is Required to Perform

- It has the ability to import and export commodities.

- Professional and consulting services are provided.

- Conduct research in all areas where the parent firm is already present.

- On behalf of the parent company, increasing technical/financial partnership.

- Working in India as a representative of a parent company and acting as a buying/selling agent.

- In India, we provide IT services and produce software.

- Indulging in the provision of technical support for the parent company's products.

- Working in India as an authorised representative for a foreign shipping or airline company.

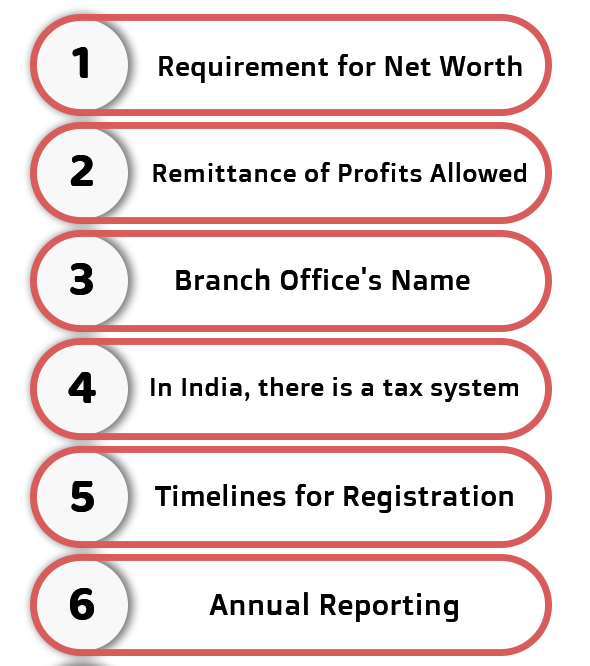

Consider these factors before establishing a branch office in India.

The Branch Office's name must be comparable to the parent companies. Other important information to remember before applying for a branch office registration is as follows:

Requirement for Net Worth

A foreign parent business must have a positive track record for the previous five years, with a net worth of more than $ 1 00,000 as accurately stated in the financial statement.

Remittance of Profits s Allowed

Once all taxes have been paid and all books of accounts have been audited, the profit earned by the branch office can be remitted from India to the parent business.

Branch Office's Name

A parent firm and a branch office must have the same name.

In India, there is a tax system.

The income tax rate on revenues earned by a branch office of a foreign parent business in India is 40%, with additional levies. GST is a tax that is levied on the sale of goods and services.

Timelines for Registration

The time frame is predicted to be 3 to 4 weeks. It can, however, differ from instance to situation.

Annual Reporting

The branch office is intended to meet the Ministry of Corporate Affairs', ROC's, and Income Tax Department's filing criteria.

List of Documents Needed to Register a Branch Office

In the process of registering a Branch Office, precise and correct documentation is critical. As a result, documentation must be current and valid.

Documents from the parent company are required.

- Certificate of Incorporation

- Association Memorandum.

- Articles of Incorporation

- Complete list of the company's directors and key executives.

- Complete list of the applicant company's shareholders.

- Certified Public Accountant's attestation of net worth (CPA).

- The audited financial statements from the previous five years.

- In the host country, a report from the applicant's banker.

Documents Required for The Registration of the Office Address

- 5 passport copies are required.

- Five passport-size photos

- A copy of your business visa with your arrival stamp from Immigration.

- A total of 5 copies of the National Identity Card are required.

- Recent proof of address (utility bill, phone bill, water bill, bank statement).

- In the name of AR, a Power of Attorney is granted.

- The AR is appointed by a Board Resolution

Forms and Documents for the Government

Following receipt of the complete set of authentic documents, the applicant company and the authorised signatory must draught the following documents for signature purposes.

- Resolution of the Board of Directors approving the establishment of a branch office in India

- The applicant made a declaration on FDI eligibility and funding source.

- A statement describing the nature of the business's activities and the location of the proposed Branch Office's activities.

- A statement on the type of the business activity and the business entity's location.

- Fill out the FNC form

- The controlling company's letter of assurance.

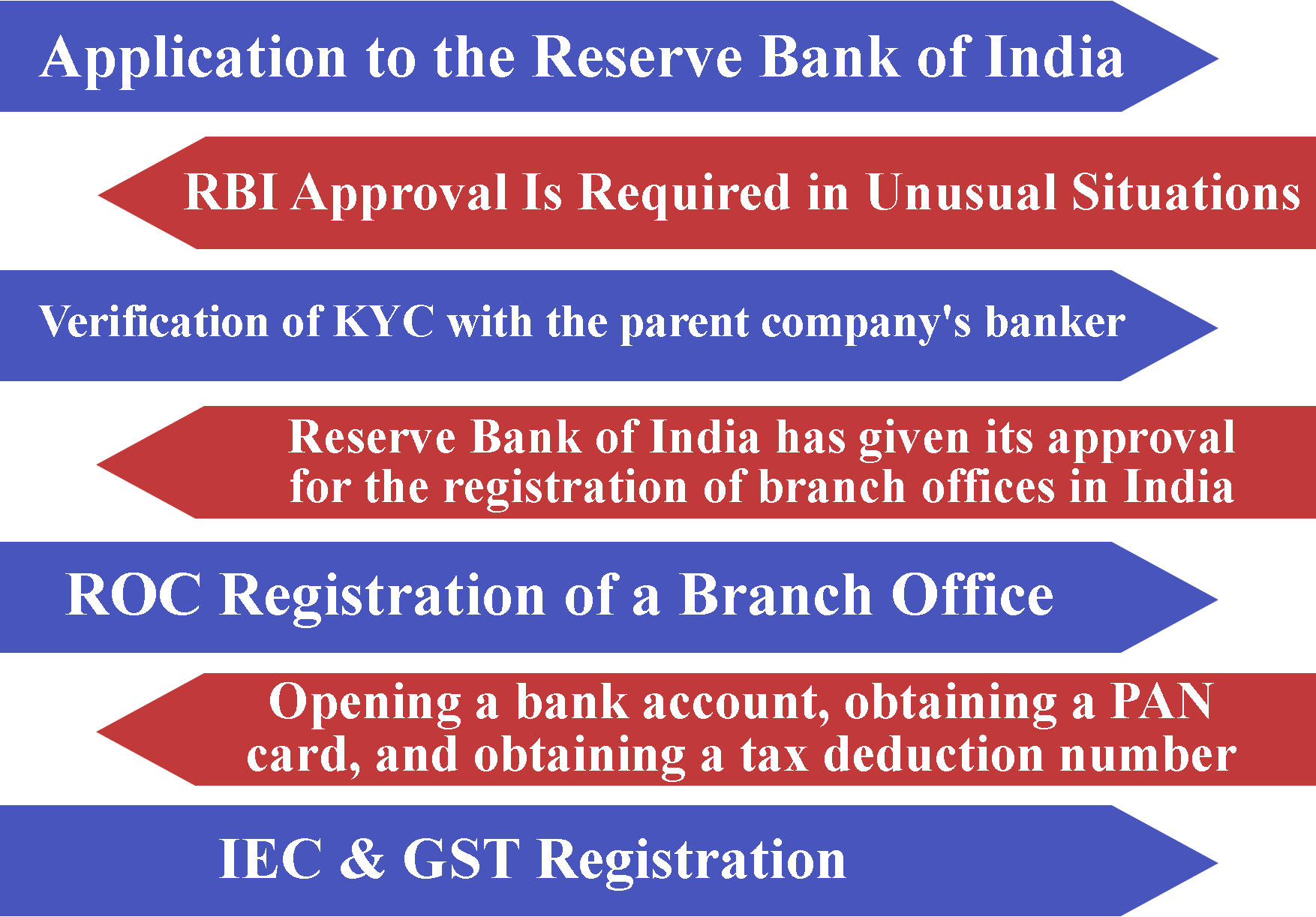

Process for Branch Office Registration

In India, there is a process for registering a branch office.

Application to the Reserve Bank of India

BAn application for a foreign corporation is filed in FNC through the AD Bank Branch office. The application is submitted through AD Bank to the Reserve Bank of India (Authorised Dealer Category 1 prescribed by RBI). The AD bank plays a crucial function because it is through them that all contact with the RBI is routed.

RBI Approval Is Required in Unusual Situations

In the RBI's unique instances, the AD bank needs prior clearance. Entities whose primary economic activity is in a sector that allows 100 percent FDI are given the automatic path.

The situations in which the bank need prior clearance.- The applicant is a citizen of Pakistan, Afghanistan, Iran, China, Bangladesh, Sri Lanka, Hong Kong, or Macau, and the application is for the establishment of a BO/LO/PO in the North East area, Jammu and Kashmir, or the Andaman and Nicobar Islands.

- The four main business sectors are telecommunications, private security, defence, and information and broadcasting.

- The applicant is a non-profit organisation.

Verification of KYC with the parent company's banker

A request for document review is addressed to the banker of the foreign company. Swift-based verification refers to the procedure of making a request for verification. The application is preceded for approval purposes once the foreign banker has confirmed the materials. The RBI/AD may also request other documentation, depending on the circumstances.

Reserve Bank of India has given its approval for the registration of branch offices in India

The AD Banker follows a precise procedure when it comes to approving the branch office in India. The scenarios when the automatic route is not available are given priority.

ROC Registration of a Branch Office

Within 30 days of receiving RBI approval to open a branch office in India, a foreign business must file an application in form FC-1 for branch office registration in India. In the event of an Indian director on a board, the authorised signatory's digital signature is necessary for e-filing statutory papers with the ROC.

Opening a bank account, obtaining a PAN card, and obtaining a tax deduction number

PAN numbers are issued by India's income tax agency and are unique 10 digit numbers. The branch office can open a bank account once it has received its PAN number. To comply with all TDS regulations, every taxpayer must get a Tax Deduction Account Number.

IEC & GST Registration

When you get a bank account and a chequebook, you'll need a copy of the check to register for GST registration and an Import Export Code.

Branch Office Reporting on a Regular Basis

It will also be required to notify ROC of certain modifications as they occur.

In the FC-2 form

- Notifying RBI and ROC of any changes in the structure of a foreign company.

- Notifying RBI and ROC of any changes in the directors of a foreign company.

- Notifying RBI and ROC of any changes in the BRANCH office.

- It is not possible to open a new business location without first obtaining RBI approval.

- RBI clearance is required before any additional action can begin.

Fund’s repatriation

Branch Office profits are freely remittable from India, subject to payment of appropriate taxes.

Additional Business Licenses that apply to the Branch Office

- The pan number is the permanent account number.

- Tan number – tax deduction number Shop and business.

- Service of Registration If the branch performs any services in India, it must be tax registered.

- If the branch conducts business in India, it must register for VAT and CST.

Branch Office Closure

The BRANCH office licences are typically granted for three years; however, if the Company wishes to close the BRANCH office created in India, it must file the relevant documentation with the Authorized Dealer, who will then forward the application for closure.

- For establishing the BO / LO, a copy of the Reserve Bank's permission/approval from the sectoral regulator(s).

- Auditor's certificate- I) indicating how the remittable amount was calculated and supported by a statement of the applicant's assets and liabilities, as well as the manner in which assets were disposed of; ii) confirming that all liabilities of the Office in India, including arrears of gratuity and other benefits to employees, etc., have been either fully met or adequately provided

- For the remittance/s, a letter of no objection or a tax clearance certificate from the Income-Tax Authority is required.

- Confirmation from the applicant/parent company that no legal procedures in India are pending and that the payment is not hindered by any legal issues.

- In the event that the Office in India is wound up, a report from the Registrar of Companies regarding compliance with the provisions of the Companies Act, 1956.

- Any other document(s) that the Reserve Bank specifies for granting approval

List of Prohibited Activities in Branch Office

Companies formed outside of India are barred from carrying out the following operations through an Indian branch office.

- A Branch Office in India is not permitted to engage in any retail trading activity of any kind.

- A Branch Office is not permitted to engage in direct or indirect manufacturing or processing activities in India.

- Branch Office profits are freely remittable from India, subject to payment of appropriate taxes.

Why Choose Us

Free Legal Advice

Transparent Pricing

On Time Delivery

Expert Team

Money Back Guarantee

200+ CA/CS Assisted

Lowest Fees

Easy EMIs

Frequently Asked Questions

If a foreign firm has a five-year track record of profit generating and sufficient capital resources, it can operate a branch office in India. A budget summary that has been appropriately certified by the parent organization's legal inspector is required.

Pakistan, Bangladesh, Sri Lanka is a country in South Asia, Afghanistan, Iran, China, Hong Kong, Macau. Alternatively, any application for the establishment of a branch office in Jammu and Kashmir, the North-East Region, or the Andaman and Nicobar Islands.

9559179325

9559179325 9559179325

9559179325 9559179325

9559179325