Brief on GST Advisory Service

In today’s era, the need for GST Advisory Services is getting increased due to its complex form. GST stands for Goods and Services Tax. It is treated as an indirect tax on the supply of goods and services. GST is also said as a comprehensive tax because it replaced multiple indirect taxes like VAT, Excise duty, Service taxes, etc. As a whole, GST is said as a single domestic indirect tax in India.

In India, GST was brought into effect in 2017. It is executed on all the business activities be it goods or services provided or performed in India. The main aim of GST was to curb the cascading effect of various indirect taxes in India. GST has a great impact all over the country. It has created a change not only in the tax system but a change in business patterns, the Indian economy, Producers, Traders, E-commerce, and Telecom Sector, etc.

GST is one of the largest reforms in the indirect tax system since independence. It is the unified tax for all of India on both goods as well as services. It is a drastic change in the economy of India. It not only impacts the tax system of India but also changed a lot in other business operations. Hence GST is very important with respect to the price of goods and services, accounting, business operations, etc. For the better running of this system, GST Advisory Services plays a very important role. This service page is totally dedicated to the GST Advisory Services.

What is GST?

GST refers to Goods and Services Tax. It is a unified tax for all over India. It is treated as an indirect tax on the supply of goods and services. GST is also said as a comprehensive tax because it replaced multiple indirect taxes like VAT, Excise duty, Service taxes, etc. As a whole, GST is said as a single domestic indirect tax in India. GST has a great impact all over the country. It has created a change not only in the tax system but a change in business patterns, the Indian economy, Producers, Traders, E-commerce, and Telecom Sector, etc. Every firm with a certain turnover needs to have GST Registration.

What is GST Registration?

Replacing all indirect taxes, the Goods and Services Tax was introduced to provide a single umbrella to all the separate minimal taxes. This provided for the customer to overcome several taxes at the same time. The Goods and Services Taxes were imposed on goods and service providers with a turnover of more than Rs 20 Lakhs. While enterprises with a total turnover of Rs 20 Lakhs were given the option to voluntarily opt for the GST Registration, enterprises with a turnover of more than 40 Lakhs are supposed to mandatorily register themselves under the GST Registration facility. The GST Registration is the process that acknowledges the enterprises in order to provide benefits under the GST laws. The GST laws provide for certain facilities and concessions to the registered enterprises by acknowledging their GST Registration certificate.

Benefits of GST Registration

The following are the benefits of GST Registration-

- Helps regulate unorganized sectors.

- Easy cross-border marketing.

- Regulated functioning of e-commerce.

- Lesser compliance, prevent tax cascading effect.

- Easier online mode of working.

- Reduce hurdles between administrators and taxpayers.

- Increased authenticity and brand value.

GST Advisory Services and BizAdvisors

The BizAdvisors provide facilities for GST Advisory Services. The Experts assist clients with GST-related issues such as analyzing the impact of GST on customers' businesses, researching various market scenarios for business models, legislative business level implementation help, transition management, and key compliance.

GST Advisory Services by Bizadvisors have several features and we are working as a game changer for the client's business by availing them of great business GST plan offers. We set plans in such a way that the benefits arising are expected to extend further in the future and will give long-term benefits. BizAdvisors are very closely involved in the monitoring of the GST Advisory Services. It can be anything related to the GST.

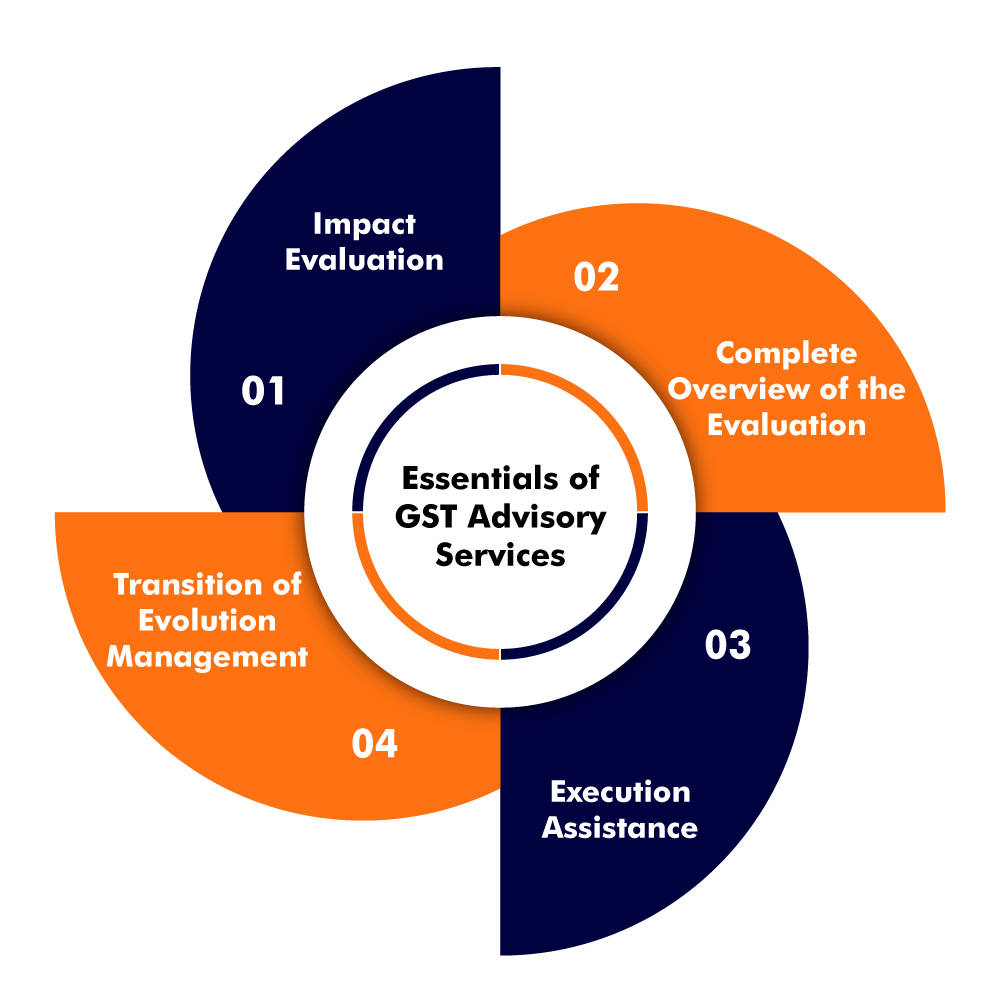

What are the Essentials of GST Advisory Services?

At Bizadvisors, there are professionals who observe the changes in the market and direct the clients according to their needs. We provide specialized GST Advisory Services, including analyzing the impact of GST on business, scenario analysis including the alternatives business model, guidance for implementation of business level, undertaking the key compliances, and managing the transition. Following are the essentials for GST Advisory Services-

- Impact Evaluation

- Complete Overview of the Evaluation

- Execution Assistance

- Transition or Evolution Management

To carry out specific research on the GST in the field and evaluating its impact on the business is the first preference for us to perform. And identify the manner in which opportunities could be improved.

The evaluations are later focused on the business as a whole and identify the possible scenario of the opportunities or issues which could be maximized or minimized for the business purpose.

Assisting in making the relevant changes required in the business. Also reviewing and suggesting changes in documentation, process, and policies to meet the GST requirements. Assisting in the manner by which GST credits and liabilities can be auto-picked for tax payouts and compliances.

Complete analysis of the GST registration process. Assisting in meeting the first cycle of GST compliances, [invoice formats, returns, etc] in transitioning the tax credits and liabilities, addressing individual needs such as suggestions related to assistance.

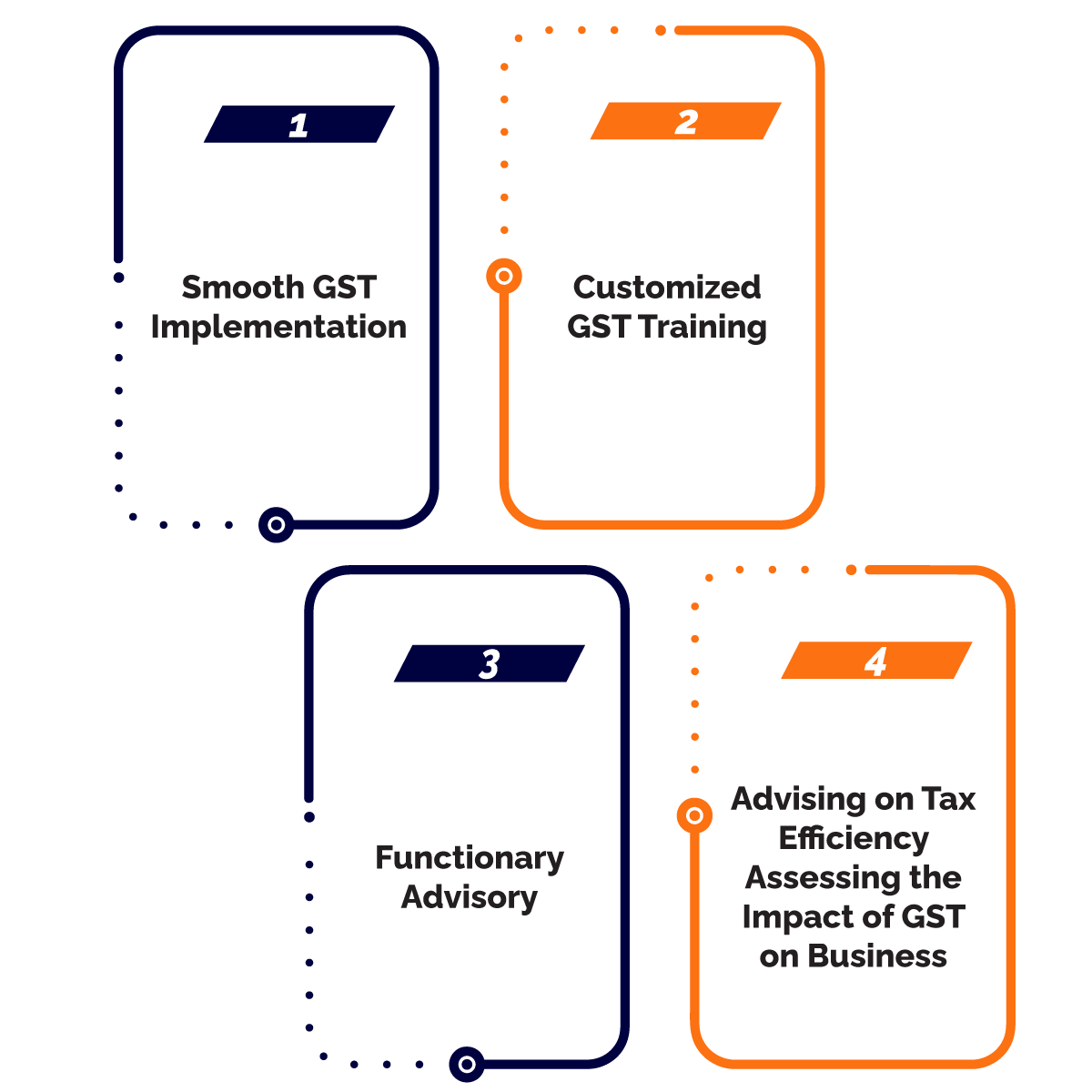

Role of GST Advisory Services

The role of GST Advisory Services is given below in detail-

- Ensuring Steps for Smooth GST Implementation

- Customized GST Training

- Functionary Advisory

- Customized GST Trainings

- Advising on Tax Efficiency

- Assessing the Impact of GST on Business

GST Advisory Services provides assistance in obtaining GST Registration. It provides guidance in the manner of recovery tax from customers. It evaluates and updates eligibility for GST and the transferability of existing input tax credits. It helps in the preparation and updating of compliance manuals/SOPs. With the help of GST Advisory Services, proper assistance is provided for credit availability for the GST regime.

Customized internal training is provided for managerial requirements for Finance, Taxation, Legal, Commercial, Sales, and Marketing departments; and also training for vendors, suppliers, and customers is provided.

The IT Systems are tested till confirmation and later provide the report accordingly. Examining the already existing IT System to provide the tax triggers and mapping for each of the customer’s business transactions. Proper guidance is provided for credit notes and debit notes, invoices, and other document functions. Evolve logic basis the changes introduced in law including those for the transition of credits Arranging the tax rates accordingly and updating the master files on the basis of tax schedule according to the customers’ needs.

Internal training is provided to departments for Taxation, Legal and Commercial, Sales, Finance, and Marketing accordingly. Training for vendors, suppliers, and customers is also provided.

Evaluates the GST impact on the goods and services pricing. Advising for the relevant cost mechanism to be used in consideration for additional savings/burden. Advising for appropriate precautions to be adopted. To represent before the Regulatory authorities established for anti-profiteering.

Change in tax rates has been assessed. It helps in the impact assessment for onward supplies. There can be changes made for time and place for the goods or services supply or both.

Key Areas related to the GST Advisory Services

Key areas related to the GST Advisory Services are given below-

- Evaluation of the fiscal impact of Goods and Services that is GST on the businesses.

- Examining the price of the product with the help of the key parameters like change in tax rate or time etc.

- Examination of the impact of the outward supplies and with it also analyzing the impact on the procurement of inputs and services.

- This act requires a good and detailed understanding of each and everything related to the registered business which can be possible through knowledgeable expert advice.

- Advisory services related to Goods and Services that are GST are asked for by the clients due to the changing GST Law.

- Anti-profiteering provisions under the GST Laws will also come under the key areas of the GST Advisory Services.

- Advice has been given under the GST Advisory Services related to the appropriate pricing mechanism.

- Advice has been given about the appropriate safeguards which should be adopted by the business holders.

- Representation before the regulatory bodies which have been specially constituted for Anti-profiteering.

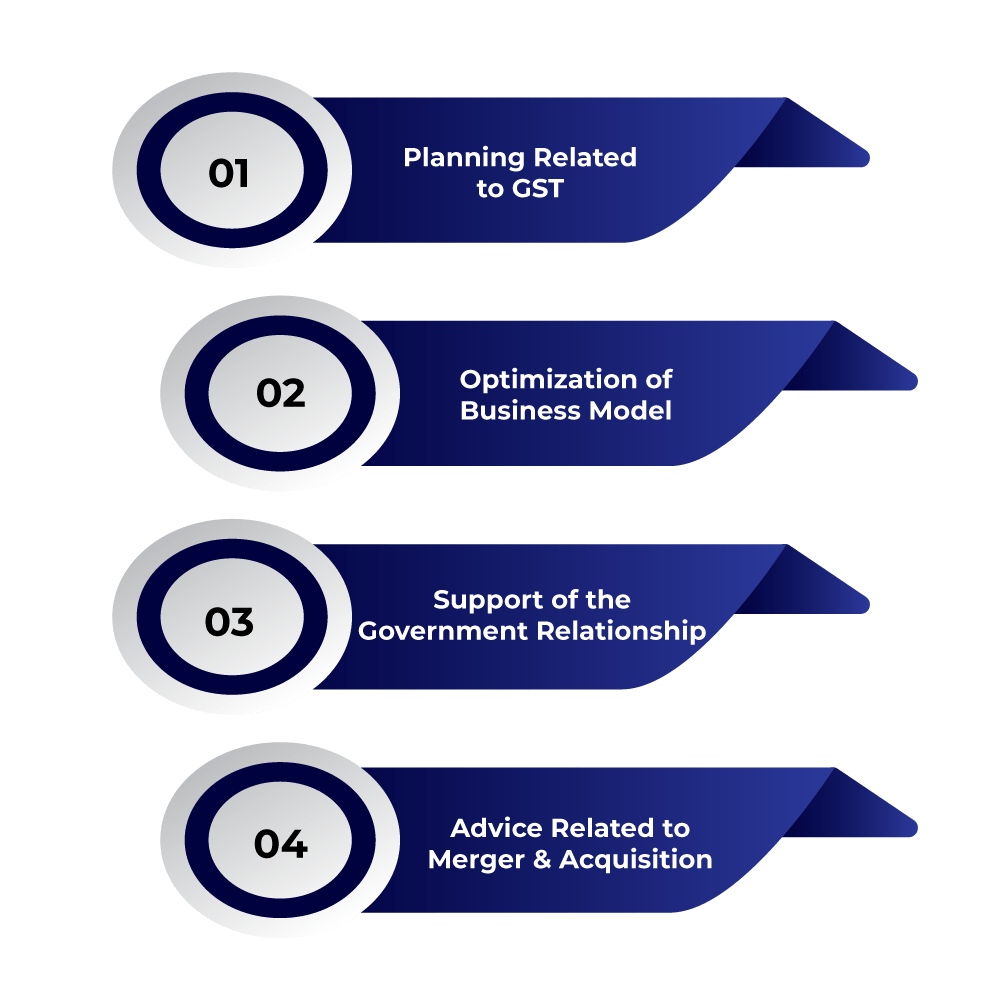

Special Support of BizAdvisors in GST Advisory Services

BizAdvisors provides special support in the GST Advisory Services with the help of the following points-

- Planning Related to GST

- Optimization of the Business Model

- Support of the Government Relationship

- Advice Related to Merger and Acquisition

Our team of experts makes strategies that help in identifying the opportunities which will surely help in the reduction of the GST liabilities, minimize compliances costs and also improve the cash flow of the business.

BizAdvisors GST Advisory Services helps in the realigning of the business for their transformation and also helps in the realigning of the legal and tax structure of any business.

BizAdvisors engage or liaise the client with the Government Authorities. This will help the client in many ways such as Auditing by the Government Authorities etc.

To avoid the hidden taxes and the hidden tax consequences, BizAdvisors GST Advisory helps in proper Merger and Acquisition and also helps in the determination of whether the acquisition is subject to GST or not.

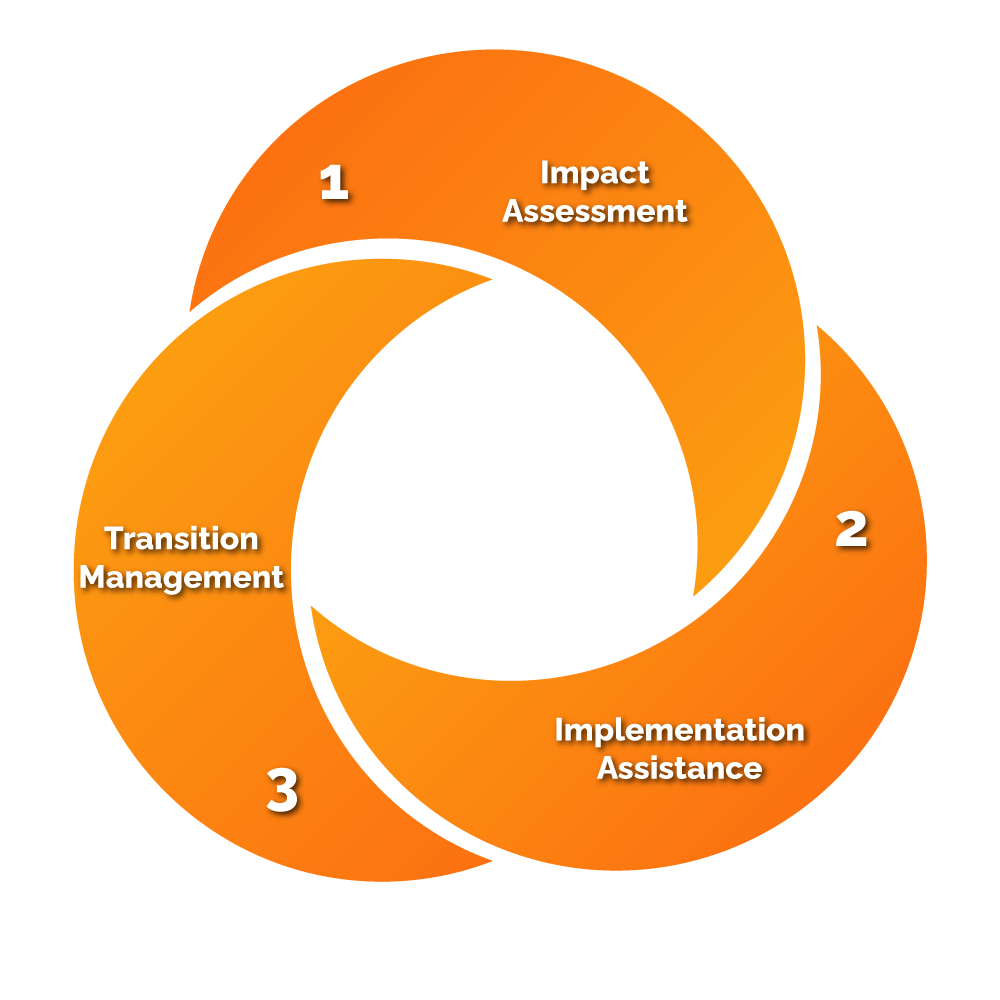

How BizAdvisors Provide GST Advisory Services?

BizAdvisors provides GST Advisory Services in the following manner and with the help of the following calculation-

Broad Impact Assessment of GST Advisory Services

- Specific concept level with respect to the particular impact areas has been developing, on the basis of the information which is in the public domain.

- Impact areas have been shifted into the area of opportunity and threats.

- It will be a great help to the GST policymakers to minimize the impact areas.

- It helps in the identification of the manner in which opportunities can be improved.

Implementation Assistance of the GST Advisory Services

- Custom design changes with respect to the ERP, Internal Controls, and Accountings.

- If there is any change in the supply chain then assistance in the making of changes in the supply chain has been provided.

- Review the relevant documents.

- Suggests the changes required in the documentation.

- Processes and various policies have been made to meet the requirements related to the GST.

- Plot the manner so that the GST credits and related liabilities can be auto-picked related to the compliances and the tax pay-outs.

Management Related to Transition or Transition Management

- GST Registration service has been provided in the entire jurisdiction, especially where it is required.

- Assistance has been provided to fulfill the compliances related to the GST.

- Help and assistance in the transitioning of the tax credits from the IDT System to the GST System with the help of the Transition Rules.

- Help and assistance in the liabilities from the IDT System to the GST System with the help of the Transition Rules.

- Special needs of the address such as suggestions related to the state incentives.

Free Legal Advice

Transparent Pricing

On Time Delivery

Expert Team

Money Back Guarantee

200+ CA/CS Assisted

Lowest Fees

Easy EMIs

Benefits of GST Advisory Services

Following are the benefits of the GST Advisory Services-

- Helps in the determination of the prices related to the goods and services.

- Helps the clients to do proper things about the GST.

- Due to new GST laws clients are confused, GST Advisory helps them to curve their confusion.

- Helps in the growth of the business.

- Helps in fulfilling the compliances.

- Proper auditing can happen.

- Helps to secure a company from hidden taxes consequences.

- Proper Mergers and Acquisitions are done by them to curve the hidden taxes consequences.

- Smoothen the path towards GST.

Why you should choose Bizadvisors?

BizAdvisors is one of the platforms that work together to meet all of your legal and financial needs while also connecting you with dependable specialists. Yes, our clients are happy with the legal services we provide. They have continually regarded us well and provided regular updates because of our focus on minimizing legal requirements. Our clients can also keep track of the progress on our platform at any moment. Our knowledgeable professionals are here to answer any queries you may have concerning the GST Advisory Services. BizAdvisors will make sure that your interactions with professionals are pleasant and smooth. Following are the reasons one should choose Bizadvisors-

- BizAdvisors is one of the many platforms which coordinate to fulfill all your legal requirements.

- It connects you with a team of expert professionals who can help you in every possible way.

- Its focus is on simplifying the legal requirements for the client.

- If you have any questions regarding GST Advisory Services we are just one phone call away.

- We have a very dedicated team that is ready to help you and guide you.

- Our mission is to create a hustle-free and easy-to-use system for the concerned consumers of our services.

- We give you reliability and trust.

- We make sure that we will provide you with the best services and can satisfy you with our quality work.

The government has introduced the GST system and is trying to smoothen the path towards it. For such GST Advisory Services must be obtained by the GST applicant. Being GST compliance businesses experience the merits of having a unified tax system and easy input credits. For the adoption of GST, various changes have been made in the industries, and maintaining such things for the future is also a challenging part. GST Advisory Services are becoming an important aspect before filing for GST or any other form in it for the business. As the experts would help you to avail more benefits out of the box which would become more helpful for the business profits. On the other path, GST could also be termed as complex. Thus you can consult our professionals at BizAdvisors for GST Advisory Services. We offer all services related to GST. So make your path for GST without any trouble by contacting BizAdvisors.io for BizAdvisors GST Advisory Services.

Frequently Asked Questions

GST rate on consultancy services attracts 18% of the GST Rate. Consultancy could be related to Finance, Commercial, Legal, Healthcare, etc. Though there are five slab rates, consultancy services fall under 18% slab only.

GST is mandatory even if you are providing services only to clients outside India. GST is also applicable to any voluntarily registered freelancer.

Currently, there are four types of GST in India that are as follows:

- CGST – Central Goods and Service Tax.

- SGST – State Goods and Service Tax.

- IGST – Interstate Goods and Service Tax.

- UTGST – Union Territory Goods and Service Tax.

- Clubbing Taxes: the biggest challenging feature of GST is to club all the indirect taxes into one umbrella, which is the most difficult part of GST.

- Framework for Tax Disputes: proper framework of laws and their procedure is required to be maintained so as to avoid any disputes and confusion among the Individuals.

- Training to Tax Administrative staff: the GST is different from the other tax system in India. Thus it requires proper training for the Tax department for the proper implementation.

The following are the entity that is eligible for GST registration:

- Individuals who pay tax as per reverse change.

- Businesses that have a turnover more than the threshold limit.

- E-commerce aggregators.

- Individuals who supply through e-commerce aggregators.

- Agents of input service distributors and suppliers

- Non-resident individuals who pay tax

- Individuals who have registered before the GST law.

9559179325

9559179325 9559179325

9559179325 9559179325

9559179325