Overview of Producer Company Annual Compliances

A company is a legal entity having its separate identity from its owner incorporated for a lawful purpose. It is an association having a legal entity for the purpose of conducting business. The Companies Act, 2013 governs the laws and regulations relating to any company in India including a Producer Company. Producer Companies also have certain annual compliances that they need to fulfill within the prescribed time limit. If one fails to fulfill these compliances then heavy penalties will be levied on the company. Hence it is always suggested to fulfill the annual compliances of the Producer Company to save it from any type of Fine or Penalty, which can prove fatal for one's business. Annual Compliances of the Producer Company are not easy to file. There is a lot of complicated procedure involved while filing the Annual Compliances of the Producer Company, hence expert advice is always suggested. An expert not only makes your work easy but also saves the time that such filings take. If you have a Producer Company and you want to complete its Annual Compliances then you can take our help as well. We are always there for our clients.

What is a Producer Company?

Producer Company is a developing sector of companies. In India, in recent years there are thousands of producer companies registered under the Companies Act, 2013. At present approximately we have 7500 producer companies working toward welfare of the society.

Part IX-A of the Companies Act, 2013 with reference to section 465(1) of the act deals with the constitution, fundamentals, and working of a producer company. The Companies Act has not explicitly defined a Producer Company but it states that a corporate body having objectives and activities mentioned under section 581B of the act is a Producer Company. Accordingly, the primary objective and interest of a Producer Company is to produce, harvest, procure, pool, handle, market, and sell of primary produce of the members of the company. It also includes the import and export of products and goods or services for the benefit of the company. A Producer Company may perform all the required activities itself or outsource the same.

A Producer Company is a company with limited liability and limited share capital. It should be noted that any such Producer Company cannot be converted to a Public Limited Company under any circumstances. Producer Companies can be of several types including Production Business, Marketing Business, Technical Service Business, Financing businesses, Infrastructure Businesses, etc.

How to Form and Register a Producer Company?

Section 581C states the basic requirement with respect to the constitution and formation of any producer company. As per the statute, to register a producer company, any of the following combinations can be used:

- Ten or more individuals, each of them being a producer, with no maximum limit of members

- Two or more institutions, each of them being a producer, with no maximum limit of members

- A combination of ten or more individuals and institutions, each of them being a producer with no maximum limit of members

A Producer Company can be registered with a simple process that is quite similar to that of a Private Limited Company. The very first step is to obtain a Digital Signature Certificate (DSC) and Director Identification Number (DIN) of the proposed Directors of the company. After this, the next step is the reservation of the Name of the Company. The name of a Producer Company must end with the words “Producer Limited Company”. With the approval of the name from the Registrar of Companies, the final step is to file the application for the incorporation of the Producer Company in the format as may be prescribed by the Companies Act after the drafting of the Memorandum of Association (MOU) and Articles of Association (AOA). With this, the Incorporation Certificate as a Producer Company can be received. Other essentials of forming a Producer Company are mentioned and stated under section 581C of the Companies Act of 2013.

Annual Filings of the Producer Company

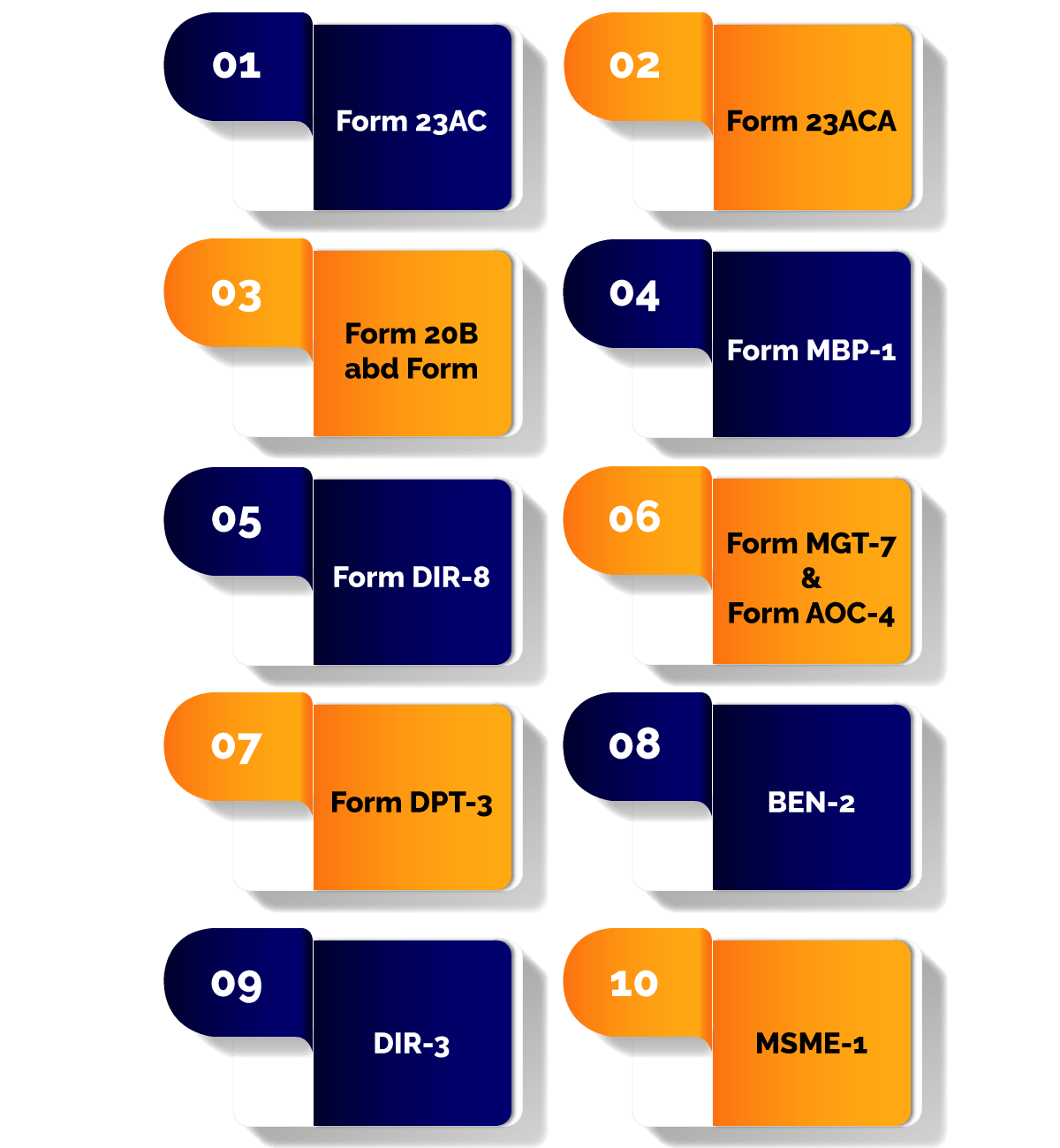

Annual Filings of the company include filings of various forms according to the rules and regulations of the relevant statutes. The audited reports and accounts of the company are used to fill the forms and file the annual filings. Annually the Audit reports along with the Director's report must be filed and submitted by every producer company to maintain its legal stand.

Before starting with the required form filing through the official website of the Ministry of Corporate Affairs, the collection of required information and documents are essential. It includes the audited profit and loss account, balance sheet, and other financial statements. The documents required include a Memorandum of Association (MOU), Article of Association, Identity proofs, etc.

- Form 23A- Section 220 and rule 7B of the act makes it mandatory for all the companies to file this form for filing balance sheet with the Registrar of Companies.

- Form 23ACA – The form is to be filed by any producer company as per section 215 of the Companies Act for filing and verification of the Profit & Loss Account of the company with the Registrar of Companies.

- Form 20B or Form 21A – A producer company needs to file either of the forms as a part of their annual return because Form 20B is to be filed by companies having share capital while Form 21A is to be filed by companies not having a share capital.

- Form MBP-1 – This form is required to be filed as per section 184(1) of the act. In the first meeting of the Board of Directors, every director must and shall disclose his interest or holdings or any changes in the interest in the previously filed forms in other entities in this form in each financial year.

- Form DIR – 8 – The disclosure form of non-disqualification under sections 164(2) & 143(3)(g) shall be filed by every director of the company with the company.

- Form MGT-7 & Form AOC 4 – These forms by the producer company must be filed as per the section of 581ZA in relation to annual return and financial statement respectively along with attaching the financial statements of the company. Annual Returns for the financial year of 1st April to 31st March shall be filed by the company within 60 days of the general meeting. Also, the financial statements of the company shall be filed within 30 days of the General Meeting. The financial statements include the balance sheet, profit and loss statement, cash flow statement, and other audit reports.

- Form DPT-3 - In respect of the return of deposits and other particulars not considered as deposits, the required form shall be filed by any producer company under section 73 rule 16 of the act.

- BEN-2 – As per section 90, any company shall file BEN – 2 before 30 days have passed from the receipt of BEN-1.

- DIR-3 – KYC (Know Your Customer) is as essential for a company and its director as it is for common people. Under rule 12A, the form relating to KYC shall be filed by every director every year before 30th September.

- MSME -1 – This form has to be filed by any producer company on a half-yearly basis as per section 405 of the legislation. This has to be filed for the period of 1st April to 30th September & 1st October to 30th March which relates to the pending payment of the company towards the MSME.

The above-mentioned list is not an exhaustive list of the required annual filing as various other compliances and filings depend upon working and individual transactions and situations. There are several other forms which are needed to be filed by all types of companies.

What are Annual Compliances of the Producer Companies?

Annual compliance refers to the specific forms that are required to file by every company including a Producer Company mandatorily during the year after the holding of the Annual General Meeting and having the financial accounts audited. Such compliance is essential and not optional for any company for its good legal stand. A Producer Company is required to file the Balance Sheet, P&L Account, and other documents with the Ministry of Corporate Affairs. Every compliance performed by the companies needs to be in accordance with the guidelines of the Companies Act, Registrar of Companies, and Ministry of Corporate Affairs.

Important Compliances of Producer Companies

Following are the main Compliance of the Producer Company

- Each year within a gap of not more than fifteen months, an Annual General Meeting (AGM) must be held.

- Each year the company must get its Accounts Audited

- Each year Annual Returns and Annual Filings must be filed.

What is Annual General Meeting?

The annual General Meeting is a very essential mode of formal and official communication and decision-making process in an organization. In a producer company, Annual General Meeting needs to be held every financial year with a gap between two meetings of not more than fifteen months. In such a meeting, decisions regarding selected candidates, budgets, loans, returns, share capital, etc. are made. While the Board Meetings of the company must take place every three months which makes it compulsory to hold 4 board meetings in a financial year.

What is an Annual Audit?

Annual Audit of the financial accounts such as balance sheet, profit & loss statement, cash flow statement, notes to account, etc. of any company including a producer company. The financial statements of the company must be audited every single year through a learned Chartered Accountant. For a producer company having an internal audit done every financial year is essential under section 581X of the act. It certifies that the company has followed and applies the compliances in every financial transaction.

Benefits of Annual Filings and Compliances

Regular annual compliance and mandatory filings benefit the company in various ways, some of them are given below-

- Firstly, it makes a good legal stand for the company.

- Helps to avoid any penalties for delayed or non-filings of the form.

- Consistent audits and tax returns filings ensure the confidence of the investors, shareholders, and other interested parties.

- Lastly, it establishes efficiency, credibility, and transparency.

- It also helps in the management of the company work.

Fines and Penalties

Non-Compliance with the above-explained rules and regulations causes and charges penalties. Such penalties differ in case of non-compliance with one or the other rules. Following are a few changes to be faced by any Producer Company when there is a failure in the application of any rules-

Failure to file the AOC-4 form to file the financial statements of the company shall attract a penalty of Rs.1000 per day which may extend up to Rs. 10, 00,000.

Non-Filling of the annual return by a producer company through Form MGT-7 shall make the organization and its officers liable for Rs. 50,000 and when the default continues the penalty of Rs.100 per day which may extend up to Rs. 5, 00,000 can be charged.

Failure to hold the Annual General Meetings in a timely manner may attract a penalty of Rs.1, 00,000 to the Producer Company.

Why BizAdvisors?

BizAdvisors is all you need under one roof or platform. This is a consultant-based organization working towards providing good and effective legal advice to everyone along with providing knowledge and awareness about the relevant topics. The learned members and specialists of the organization cater to every needed help while forming and working for your company. Every person here is connected to a specialist in the concerned field along with clear advice for better guidance and professional help. We here work tirelessly to ease out and smoothen your legal journey. Our aim is to assist you in your journey of forming, registering, and running your Producer Company without any hassles.

Among many of the service providers, you should choose BizAdvisors to have a home-like thoughtful and concerned advice accompanied by friend-like communication.

- We provide you with help with the entire legal requirement related to your Producer Company.

- We make your work minimal by providing our best services.

- We connect you with our best team of experts.

- When in doubt our professionals and specialist are there to clear the air.

- We understand and value the importance of transparency and accountability and thus give you the access to check your work in progress anytime you want.

- Time is money. And we provide you with your work on time.

- The cost and charges for our services are very much affordable with no hidden charges.

- Qualified and learned set of people including CA and CS

Once you choose us we are with you until you give up on us. We will provide all the required after services. A Producer Company has come as a ray of sunshine to boom and motivate to establish business with the aim to promote welfare. In today’s time, every business and businessman aims to promote the business in commercial limes only. In such a scenario, a producer company is a perfect mix of profit-based and welfare-based companies. Such a company has the responsibility to maintain social objectives as well as business objectives. It has features of both a company and a cooperative society.

Annual compliance and annual filing is the filing of specified forms and following the rules and regulations in accordance with the Companies Act, Registrar of Companies, and Ministry of Corporate Affairs. Proper filing of all the required forms and documents supports the legal stand of the company and helps to avoid any legal penalties. There are several guidelines and challenges which is needed to be kept in mind and followed while annual filing. For this, it is better and advised to seek help from legal service providers. It ensures the smooth functioning of the company and related legal requirements.

FAQs Regarding Producer Company

A Producer Company is not explicitly defined under The Companies Act but it states that a corporate body having objectives and activities mentioned under section 581B of the act is a Producer Company. Accordingly, the primary objective and interest of a Producer Company is to produce, harvest, procure, pool, handle, market, and sell of primary produce of the members of the company. It also includes the import and export of products and goods or services for the benefit of the company.

A producer as per section 581A (k) of the Companies Act is “a person engaged in any activity connected with or relatable to any primary produce”.

9559179325

9559179325 9559179325

9559179325 9559179325

9559179325