Overview of Legal Metrology Act Registration

There are number of commercial procedures that need to go through measurement and weighing for the improved performance. To address this issue, the government has enacted the "Legal Metrology Act." The goal of this act is to maintain business transparency and clarity, as well as to defend consumer rights.

The Legal Metrology Act aids in the management and reduction of weight and measurement inaccuracies. The clearly outlines weighing and measuring tools, units, standards, and mandatory requirements with the goal of maintaining public assurance in terms of weights and measurements accuracy and security.

The Legal Metrology Act of 2009, which took effect on April 1, 2011, begins with the following preamble:

“An Act to Establish And Enforce Weights And Measures Standards, Regulate Trade And Commerce In Weights, Measures, And Other Goods Sold Or Distributed By Weights, Measures, Or Numbers, And For Matters Connected Or Incidental Thereto.”

The Department of Consumer Affairs of the Indian government defines and implements Legal Metrology Standards. While the Legal Metrology Act of 2009, which is under central jurisdiction, has been designated as a model legislation, each Indian state has the option of accepting the act with or without modifications. However, a few states have passed their own legislation to address the challenges and concerns around legitimate metrology.

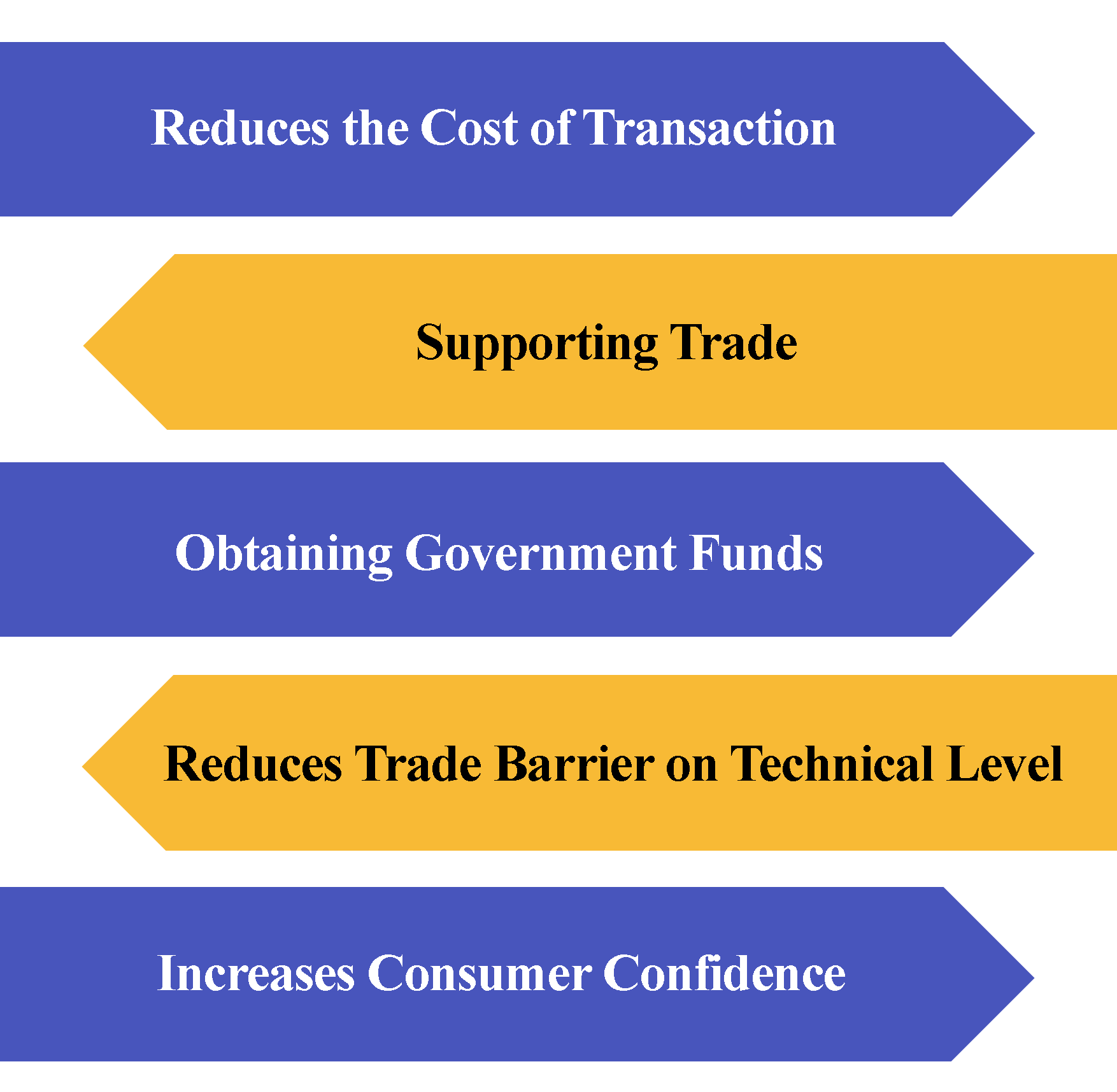

Benefits of the Legal Metrology Act Registration

Measurement is very important in business. Transparency and creating a balance between traders and customers are requirements of effective trade.

Reduces the cost of transactions

Revising bad measuring practises is often expensive and time-consuming. They have an impact on both enterprises and consumers. In fact, bringing legal action against a trader who has the courage to violate measurement laws is very costly. However, when measurements are performed precisely and correctly in accordance with all of the requirements of the Legal Metrology Act, cost and time are unquestionably reduced.

The Supporting Trade

Legal Metrology Act is in charge of policing any illegal or unfair trade activities. This act's goal is to ensure that measuring instruments are in good functioning order so that they can fulfil their intended purpose and meet international standards.

Obtaining Government Funds

Excise duties on things manufactured, sold, imported, and exported, as well as taxes on measurement, are used by the government to generate money. The Legal Metrology Act ensures that neither the government nor businesses are treated unfairly when it comes to tax payment. Especially in things like timber, rice, coffee, palm oil, coal, iron-mineral, gold, jewels, and natural gas, the deal by proportion of mass products might be a significant component of both export and national pay.

Reduces trade barriers on a technical level.

The Legal Metrology Act eases the burden of technical restrictions and improves measuring confidence and clarity. Fewer barriers boost national morale and encourage citizens to participate in the global commercial system, resulting in increased national economic growth. A merchant can avoid unnecessary hurdles in the adoption, application, and assessment of technical rules, standards, and conformity assessment procedures by using the Legal Metrology Act.

Increase Consumer Confidence

80G Registration Procedure

When customers realise, they are obtaining a product that has been confirmed according to particular norms and laws, their faith in the businessman grows, which leads to a strong trading connection.

Documents required for Legal Metrology Act Registration

The following is a list of documents that the manufacturer requires:

- Photographs, evidence of identity, and evidence of address of the applicant/partners.

- Proof of the applicant's/partners' dates of birth.

- The prospective premises' ownership or tenancy document.

- A map of the location

- In the case of partnership firms, the partnership deed is used.

- If needed by the Legal Metrology General Rules, 2011 with respect to the proposed weighing and measuring apparatus, a model approval certificate given by the Director, Legal Metrology, Government of India.

- There are no objections. Particularly in the Taj Trapezium zone, a certificate from the environmental control board is required.

- The following is a list of machines and tools.

- Affidavit stating that the applicant would follow the legal provisions and the Controller's instructions.

- Affidavit stating that the applicant has never been convicted of a crime and that no criminal proceedings are currently pending in any court.

- As the case may be, a factory/shop/establishment/municipal trade licence registration paperwork is required.

- A copy of your VAT/CST/GST registration is required.

- A duplicate of PAN.

In Weights and Measures, a list of documents for the repairer is as follows:

- Proof of your identity.

- Two passport sizes are available.

- Certificate of Industry Registration

- Competent Authority's approval is required.

- Documentation of Premises Ownership / Lease Agreement.

- In the case of a sole proprietorship or partnership, the constitution must be followed. In the case of a company register, a registered document is required. Along with a copy of the Articles of Association and Memorandum of Association, a certificate issued under the Companies Act is required.

- Employee copies of appointment letters with photographs, if applicable, qualification and experience certificates;

- a list of machineries, tools, and accessories with purchase invoice.

- In the event of a new Verification Certificate, a purchase bill for test weights is required.

- Certificate of GST Registration

- Certificate of Professional Tax Registration

- A valid labour licence is required.

Weights and Measures Dealer's License:

- Identification and proof of residency are required.

- Two passport sizes are available.

- A letter of consent from the manufacturer appointing you as a dealer.

- If you plan to import weights and measures from outside the state, you'll need a Manufacturing Licence.

- Approval of the Model To be dealt with is a certificate of weights and measurements.

- Proof of ownership or a lease agreement for the premises.

- GST registration, professional tax registration, and a labour licence are all required.

Registration of the Legal Metrology Act's Functions

The importance of accuracy and precision in measurement cannot be overstated. A simple and effective legal metrology framework builds trust in trade, industry, and buyers, and creates a conducive environment for conducting business.

- Commitment to the nation's economy by increasing income in many sections

- Taking an active part in reducing revenue losses in coal, mining, industries, petroleum, and railways.

- In the infrastructure industry, limit the amount of loss and wasted.

Thus, the activity of the Legal Metrology is critical to the public interest. The Executive, Legal Metrology is a statutory entity with powers and responsibilities relating to the interstate trade and business of weights and measures, including pre-packaged products, as defined by the Legal Metrology Act, 2009. The Director of Legal Metrology is also responsible for establishing legal metrology standards and ensuring the discernibility of legal metrology standards. The Director's primary responsibilities are in the areas of Regulation, Enforcement, and Research, as well as the ability to conduct specialised field investigations, searches, seizures, workplace enlistment, and indictments. -

Legal Metrology Act Registration Procedure

Instructions for Registration

Here are some registration guidelines for traders to follow throughout the import/export of products. Section 47 of the Standing of Weights and Measures Act, 1976, covers weight measurement.

- Application for underlying registration of name in the organization's name and reestablishment of registration of exporter/importer of weight or measure must be steered through the controller of Legal Metrology of the State/UT in which the exporter/importer is arranged, along with a request draught for Rs. 10/- for "Pay and Accounts official" D/o Consumer Affairs, New Delhi.

- The list of things for weight OR measure is defined in the General Rules, and only those things are registered.

- If it's missing something, return it to the Controller of Legal Metrology within 7 days of receiving it, with notice to the applicant.

- If the application is incomplete in every way, the registration certificate will be issued to the applicant within 10 days after receipt under the supervision of the controller of Legal Metrology.

- The procedure for registration is defined in Rule 15 of the Legal Metrology (General) Rules, 2011. The Twelfth Schedule of the Rules explains the cost structure, whereas the Tenth Schedule explains the application format.

- Importing standard weights and measures, or sections of them, is possible.

- Producers and merchants would need to register as importers with the Director of Legal Metrology, Government of India.

- The application must be filed to the Director of Legal Metrology in the required form, through the State Controller, at least one month before to the import, together with the statutory charge of Rs 100. The Controller will send the application along with a report on the importer's predecessors and technological capabilities.

- The registration is valid for 5 years and can be renewed.

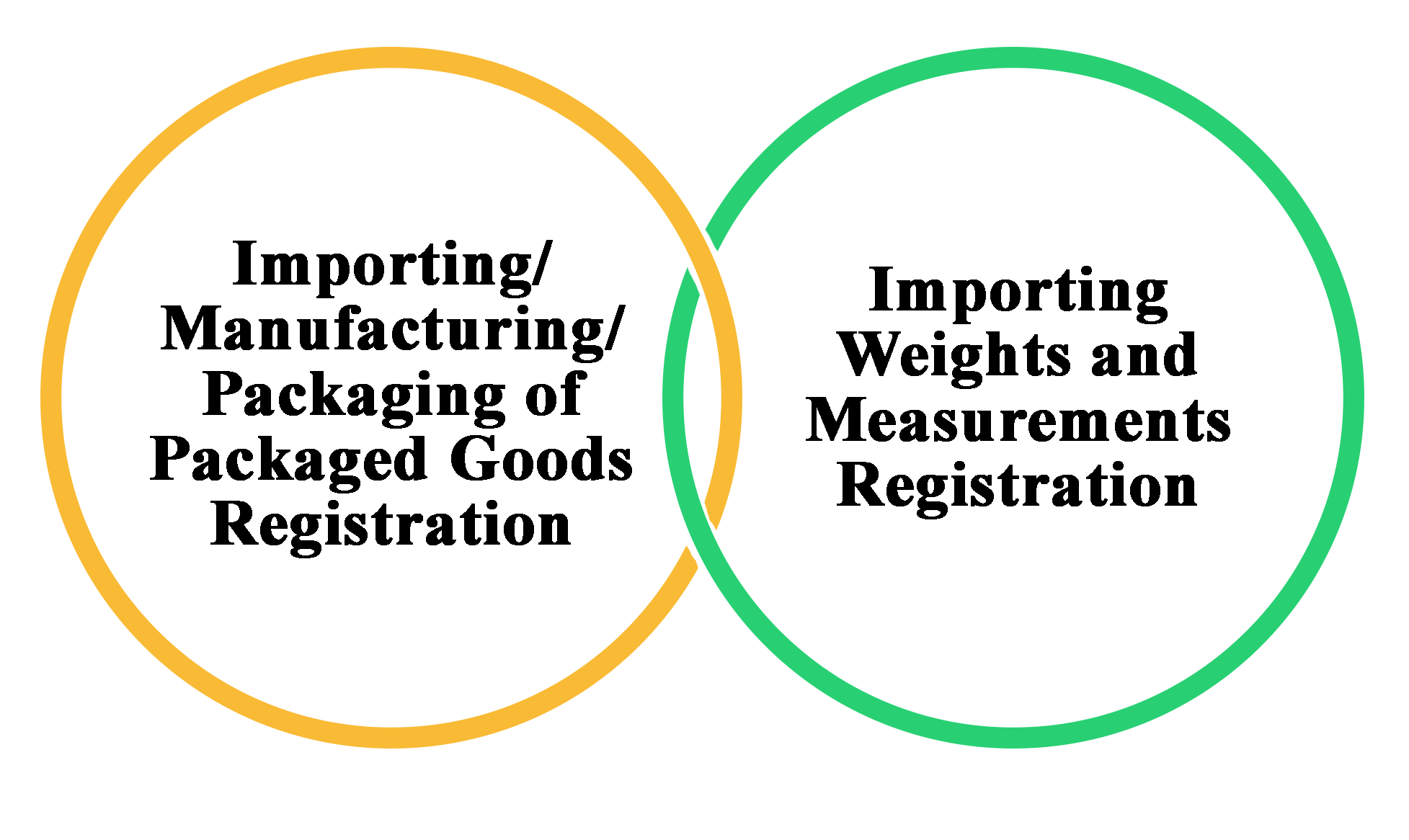

Who needs to register?

Registration is required under the Legal Metrology Act of 2009 in the following circumstances:

Case 1: Importing/manufacturing/packaging of packaged goods registration

Every importer, maker, or packer of packaged commodities must register under Rule 27 of the Legal Metrology (Packed and Commodities) Rules, 2011. The registration can be done with the Central Government's Director of Legal Metrology or the State's Controller of Legal Metrology where the importing or pressing is completed. The following conditions apply throughout the country, regardless of where the registration is completed.

Case 2: Importing weights and measurements registration.

Legal Requirements

Section 19

No person has the power to import any weight or measure unless he has registered with the Director in the authorised manner and paid the required fees.

Section 38

If a person engages in the activity of importing any weight or measure without being registered under the Act, the person shall be fined up to Rs 25000 for the second or consecutive crime, as well as imprisoned for up to six months.

Procedure for Registration.

Other Information

Why is it necessary for your company to be registered under the Legal Metrology Act?

The Legal Metrology Act establishes specific norms and regulations for the sale and distribution of packaged goods. This act also specifies the procedures to be followed while importing and exporting commodities. If you want your firm to run smoothly and efficiently, you'll need to set up a consumer and buyer rights protection system, and to do so, you'll need to follow the act that outlines the legal metrology and measurement system.

If you do not obey the rules laid out in the legal metrology and measurement system, you may be subjected to harsh penalties and fines. This could harm your brand's reputation and stifle your company's progress.

Why Choose Us

Free Legal Advice

Transparent Pricing

On Time Delivery

Expert Team

Money Back Guarantee

200+ CA/CS Assisted

Lowest Fees

Easy EMIs

Frequently Asked Questions

The sale or distribution of all packaged goods in India, such as export goods, food products, and consumer goods, requires a Legal Metrology Certificate from the Metrology Department of Consumer Affairs, according to the Legal Metrology Act, 2009.

Importers of measuring instruments who compete for business in the Indian market must register in order to get a Certificate of Registration of Importer of Weights and Measures. The applicant must file an application for registration in schedule X under Rule 15 of the Legal Metrology Act 2009 and get it under section 19 of the Act.

9559179325

9559179325 9559179325

9559179325 9559179325

9559179325