Overview of Microfinance Company Registration

The word Microfinance Company (MFC) refers to an organization that provides financial support and assistance to rural people, low-income people, and the underdeveloped and backward sections of society. That is, the primary goal of this company strategy is to provide banking services to people from all walks of life. To start an MFC in India, however, you must first obtain a Microfinance Company Registration from the Reserve Bank of India.

A microfinance institution or corporation is also referred to as a Non Deposit Taking NBFC, which is distinct from a section 8 company. In addition, the Reserve Bank of India Act 1934 and the orders issued thereunder govern and regulate the operations and affairs of a Microfinance Institution.

Microfinance institutions were established by the Indian government in order to provide simple loans to the general public. These organizations provide financing to small and medium-sized businesses (SMEs) and other types of businesses who find it difficult to obtain loans from large financial institutions and banks. As a result, a Micro-Credit agency or a Microcredit Institution is the name given to this type of business. This organization is set up to provide small loans and funding to businesses.

A microcredit institution's loan amount is usually between Rs. 50000 and Rs. 125000 in rural areas and Rs. 125000 in urban areas. A microfinance company can be simply formed by registering it as a section 8 company under the Companies Act of 2013.

Microfinance Institutions' Role

A Microfinance Institution's main role and responsibilities are as follows:

- Provides low-income states with financial assistance.

- Rural, semi-rural, and backward areas of society are served by this bank.

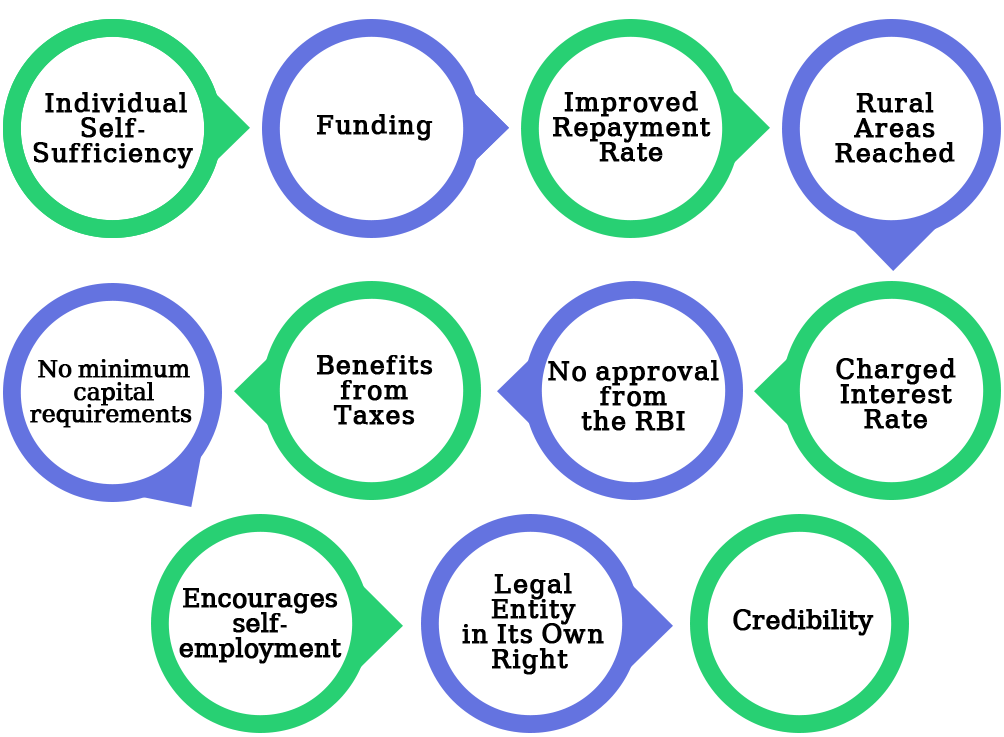

Advantages of Microfinance Company Registration

The following are the main advantages of registering a microfinance company in India:

Individual Self-Sufficiency

Once the Microfinance Company is up and running, the company's operations will be self-sufficient.

Funding

Obtaining funds to register a microfinance enterprise is usually simple.

Improved Repayment Rate

Microfinance organizations have a far higher repayment rate than banks and other institutions. This would be for short-term loans to individuals and other businesses.

Rural Areas Reached

Rural communities are more accessible to microfinance firms. These businesses can provide loans to rural communities. When compared to huge banks and companies, these financial entities are usually thought to have a greater reach.

No minimum capital requirements.

In order to start a microfinance company, there are no minimum capital requirements.

Benefits from Taxes

There are various tax incentives associated with registering a microfinance company in India.

No approval from the RBI.

There is no requirement for any sort of RBI clearance because there is a minimum compliance requirement for starting a microfinance organization.

Charged Interest Rate

In most cases, microfinance institutions are free to charge hefty interest rates. A microfinance company's interest rate might be anywhere from 20% to 25%.

Encourages self-employment

Starting this type of business stimulates entrepreneurship to meet the needs of the company.

Legal Entity in Its Own Right

Section 8 of the Companies Act of 2013 requires that a microfinance company be registered. As a result, the members of the microfinance firm have their own legal entity.

Credibility

In the perspective of the public, such a form of entity is more credible. More loan types with different disbursement options are available.

Regulations Governing Microfinance Institution Model

The following are the regulations that govern the Microfinance Institution Model:

Compliance with the RBI

The term RBI Compliance referred to the regulations governing the affairs and operations of microfinance institutions.

Furthermore, it is important to note that a Microfinance Company is free from the RBI's rules. It does, however, necessitate following the RBI's guidelines for Microfinance Companies.

Companies Act of 2013 (the Act)

It should be noted that if a Microfinance Company is incorporated as a Section 8 Company, it must comply with the conditions set forth in the Companies Act 2013.

Who is eligible to apply for Micro Finance company registration in India?

The following individuals are eligible for MFI Registration in India:

- Activities related to agriculture.

- Entrepreneurship as an artisan.

- Trades in professional and transportation services.

- Small-scale enterprises.

Perquisites for Obtaining MFC Registration in India

The following are the requirements for obtaining MFC registration in India:

- The firm must be registered under the Companies Act of 1956 and the Companies Act of 2013.

- It should have Rs 5 crores in Net Owned Funds (NOF).

- It can only provide loans between Rs 50 thousand and Rs 1.25 lakh.

- It is necessary to provide information on the promoters.

- The Qualifying Assets must account for 85 percent of the Total NOF.

- There is no minimum capital requirement.

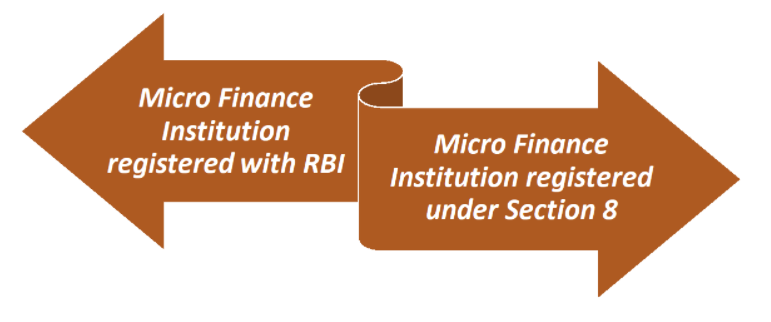

Various types of Micro Finance Company registration

The many types of MFC Registration that are available in India can be summarized as follows:

Micro Finance Institution registered with RBI

To register a Microfinance Company or Institution as an NBFC (Non-Banking Financial Company), the applicant must first register a company under the Companies Act 2013, either as a Private Limited or Public Limited Company

Following that, the said applicant firm must follow all of the steps necessary to gain microfinance company registration, starting with the minimum capital need and ending with the actual filing of the application for registration with the Reserve Bank of India's regional office.

Micro Finance Institution registered under Section 8

To form a Microfinance Institution as a section 8 company in India, the applicant company must first apply for the Digital Signature Certificate (DSC) and Directors Identification Number (DIN) for all prospective directors.

Following that, it must submit an application for Name Approval in form INC – 1. It also necessitates the preparation of the MOA (Memorandum of Association) and AOA (Articles of Association) for the aforementioned company, as well as the submission of INC – 12 together with the required papers in order to obtain Microfinance Company Registration.

Types of Loans a Microfinance Company Offers

Typically, a Microfinance Company lends small sums of money to the rural and underserved areas of society. Despite the fact that these loans are not secured, the corporation is permitted to charge interest at a rate that fits the requirements.

The following are the main characteristics of the Microfinance Company's loans:

- A Microfinance Company's interest rate should not be more than a certain level.

- It should be mentioned that the interest a Microfinance Institution charges must be appropriate.

- In addition, the requirements for the loans or cash to be granted must meet the Microfinance Company's regulations.

Documents required for registering a microfinance company

The following documents are necessary for Microfinance Company Registration:

- A copy of the company's Certificate of Incorporation (COI).

- Details of the Applicant Entity's Permanent Account Number (PAN) Card.

- Details of the planned Directors' PAN Cards.

- All proposed Directors will receive Digital Signature Certificates (DSCs).

- All nominated Directors will be assigned a Director Identification Number (DIN).

- For all of the recommended Directors, the most recent passport-sized pictures are required.

- Proof of address for the location where the company's Registered Office is located.

- If the property being used is rented, a copy of the fully stamped Lease Deed or Rental Agreement.

- If the property being used is a Self-Owned Property, a copy of the Sale Deed or Ownership Certificate is required.

- A copy of the Memorandum of Association that has been certified (MOA).

- a certified copy of the organization's articles of incorporation (AOA).

- A copy of the Banker's Report that has been certified.

- A certified copy of the Board Resolution that was passed.

- A copy of the Auditors' Report with the minimum Net Owned Funds (NOF).

- A copy of the Compliance Certificate from a Chartered Accountant who is currently practicing.

- The applicant company's structured business plan.

- A copy of the most recent financial report pertaining to the Board of Directors.

- A copy of all key managerial personnel's and proposed directors' income proof.

- The company has issued a certificate of no objection.

- No Lien Certificate from a Banker

- A copy of the company's credit statement.

- If the proposed director is an Indian national, a copy of his or her passport is required. Foreign nationals, on the other hand, must present apostilled or notarized copies of their passports.

- For each of the proposed directors, a certificate of net worth is required.

It should also be noted that the application company must provide all essential documentation, which must be no more than two months old.

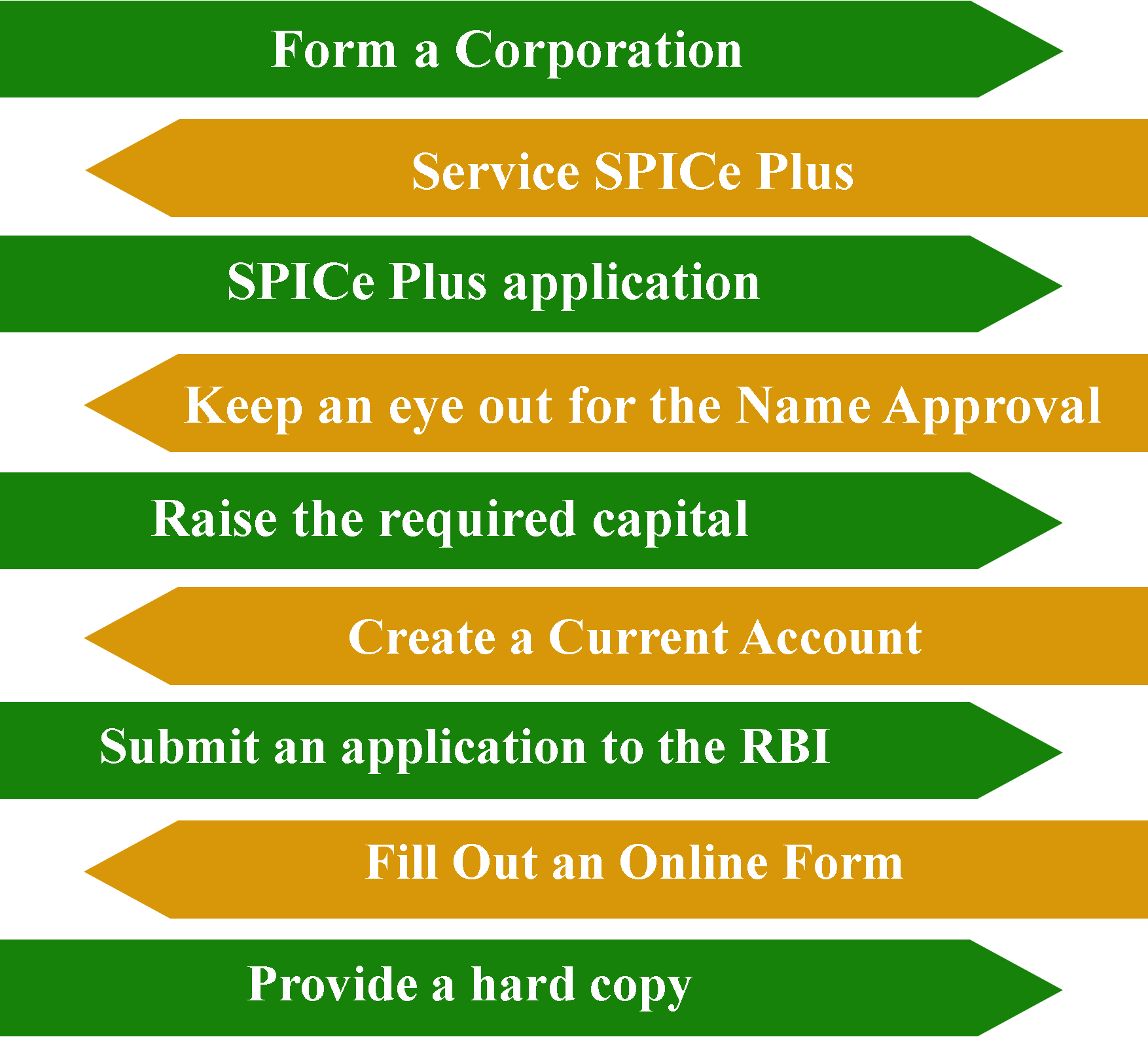

Procedure for registering a micro finance company in India

The following are the stages required in acquiring Microfinance Company Registration in India:

Form a Corporation

The applicant must first register a company under the provisions of the Companies Act 2013, which is the first and most important stage in the process of acquiring Micro finance Company Registration in India.

In addition, the applicant must file a SPICe + Form with the Ministry of Corporate Affairs in order to be incorporated.

It should also be mentioned that when a company is first established, the optimal sort of business structure for this type of organization is either a public limited company or a private limited company. The Ministry of Corporate Affairs has also removed the requirement for a minimum capital for forming a company in India by the Companies (Incorporation) Act 2015.

Service SPICe Plus

Because the entire registration procedure is conducted online, the above-mentioned SPICe Plus Service is usually readily completed by the respective applicant.

Name reservation, Director Identification Number, Mandatory Issuance of the Permanent Account Number, Tax Deduction & Collection Account Number, EPFO, ESIC, and other forms of registration will also be available through the said service.

In addition, following the conclusion of the foregoing process, the following compliances must be completed:

- If the company has been incorporated as a new business entity, the name must be reserved in that case.

- All other compliances, including EPFO (Employee Provident Fund Organization), GST (Goods and Service Tax), Income Tax, PAN (Permanent Account Number), TAN (Tax Deduction and Collection Account Number), Bank Account, and Professional Tax Registration (if required), must be completed in accordance with the law.

SPICe Plus application

Under the applicable MCA services, the candidate must select SPICE plus. Furthermore, the applicant will be routed to another page where he or she will be required to submit a new application.

It should be noted, however, that if a corporation is already in existence, it is necessary to click on an existing application. After that, the applicant must verify that the company belongs to the relevant category and subcategory.

All of a company's activities and operations must be clearly stated. As a result, if an application wishes to pursue a certain set of operations, it must also describe the sort of industrial activity.

Keep an eye out for the Name Approval.

If the firm requesting for Microfinance Company Registration already has a name, the applicant must use the auto check to meet the requirements for the company's name.

In addition, all other information pertaining to the company's name must be provided in a timely manner. Both parts A and B must be completed and submitted.

The following information, in addition to the information listed above, must be submitted:

- The applicant's company's name.

- The address of the premises that will be utilized as the Registered Office.

- The operations that the applicant company carries out.

- The company is responsible for PAN, TAN, and other registrations.

- The company must carry out a pre-scrutiny review on the registration process.

The company's directors must download all of the information requested in Part B of the form. Following that, it is necessary to affix DSC (Digital Signature Certificate) for every nominated director. It is important to remember, however, that all forms downloaded must include AGILE-Pro, SPICe+ MOA, and SPICe+ AOA, URC-1, and INC 9, and they must all be properly connected and posted online. Following that, a request number will be generated, and the applicant will be asked to make the requisite payment. Finally, the forms that have been submitted will be processed.

Raise the required capital

In the following step of the Microfinance company registration process, the applicant company must raise approximately Rs 2 crores or Rs 5 crores, depending on the regulations.

Create a Current Account

The directors of the applicant company would then need to create a current bank account as the next stage. In addition, for the above-mentioned process, a certificate stating that no lien has been created will be necessary. For this form of certificate, an application will be sent to the Apex Bank's regional office.

Submit an application to the RBI

Then, at the Reserve Bank of India's regional office, all certified copies of the paperwork required for obtaining microfinance company registration must be presented.

The following are the documentation and certified copies that must be filed with the RBI regional office:

- The ROC has received copies of the Incorporation Certificate (Registrar of Companies).

- A copy of the Memorandum of Association (MOA) that has been officially certified and.

- A copy of the Articles of Association that has been officially certified (AOA).

- A facsimile of the FDR (Fixed Deposit Receipt).

- A certificate from the company's bankers stating that there are no liens on the NOF (Net Owned Fund).

Fill Out an Online Form

To get Microfinance Company Registration in India, the applicant must now file an online registration with the Reserve Bank of India. The applicant will then be given a CARN (Company Application Reference Number) for future use.

Provide a hard copy

The applicant must submit the physical copies at the Reserve Bank of India's designated regional office in the last phase of the Microfinance Company Registration process. Following submission, the RBI will conduct a review and due diligence procedure to ensure that the company has met all of the requirements.

Why Choose Us

Free Legal Advice

Transparent Pricing

On Time Delivery

Expert Team

Money Back Guarantee

200+ CA/CS Assisted

Lowest Fees

9559179325

9559179325 9559179325

9559179325 9559179325

9559179325