Overview of Housing Finance Company Registration

Housing Finance Company is a type of non-banking financial institution (NBFI) that specializes in house construction and financing, as well as plot improvement from new house construction. In the Memorandum of Association, a Housing Finance Company must have a home finance company or a business of delivering housing finance as its principal aim (MOA). It should also be highlighted that only the National Housing Bank (NHB) has the final say on whether or not to register a Housing Finance Company.

The National House Bank Bill was introduced in 1987 by the government in order to offer loans and speed up the housing construction process. The National Housing Bank, which is an entity under the RBI, was created as a result of this statute. A person who wants to start a Housing Finance Company must first register with the National Housing Bank (NHB). The applicant would have to meet the eligibility requirements for Housing Finance Company Registration as a result of this.

A Housing Finance Company is a legal entity that is registered under the Companies Act of 2013, or an earlier company statute (Companies Act, 1956). A Non-Banking Finance Corporation is a company whose primary business activity is providing finance and loans for housing and construction projects.

The applicant must meet certain requirements in order to be registered as a Housing Finance Company:

- The registered entity's activities generate financial assets that account for 60% of the total assets.

- Individuals must be able to use 50% of their entire assets to finance their homes. The term "housing finance" refers to the following activities.

- Individuals and societies are given loans for the purpose of construction and finance.

- Loans to people who sign a contract stating that the money would be used to build a house on a certain plot within three years. This period would be three years from the time the loan was taken out.

- Loans for housing complex reconstruction and restoration.

- Any type of public institution can be lent to.

- Employee housing loans - for businesses.

- Any financing for educational, infrastructure, health, social, and cultural projects.

- Loans for slum development and construction. Such loans would be given directly to the slum on the condition that the respective Central Government or State Government Loans to Builders provide a guarantee.

The application for registration as a housing financing company must meet these standards. Housing financing companies would be classified as non-banking financial companies by the Reserve Bank of India for regulatory purposes (RBI). All housing financing companies that are registered with the NHB must adhere to the NHB's requirements.

The Reserve Bank of India (RBI) issued standards for Housing Finance Firms, and all companies that are registered must adhere to them.

National Housing Bank's Role

The National Housing Bank, or NHB, is a key player in the development and expansion of the housing financing industry. In terms of mixing with the capital and debt markets, the "Indian Housing Finance Sector" is said to be entering the second phase of its growth and development. The reason for this is that the National Housing Bank has put in place an operational system of responsive regulation in order to ensure credibility, stability, and reliability in the Indian housing finance sector's resource development, policy, and development.

Registration of a Housing Finance Company has its Advantages

The following are some of the advantages of registering a housing finance company:

Individuals Receiving Housing Loans

Individuals can borrow money from such companies, which are registered and formed with the exclusive goal of offering house loans.

Companies should be able to get housing loans

These businesses would also issue housing loans to businesses that wanted to lease out space to their employees.

Redevelopment

Redevelopment activities, such as the development of slums and rural areas, can be carried out by such companies.

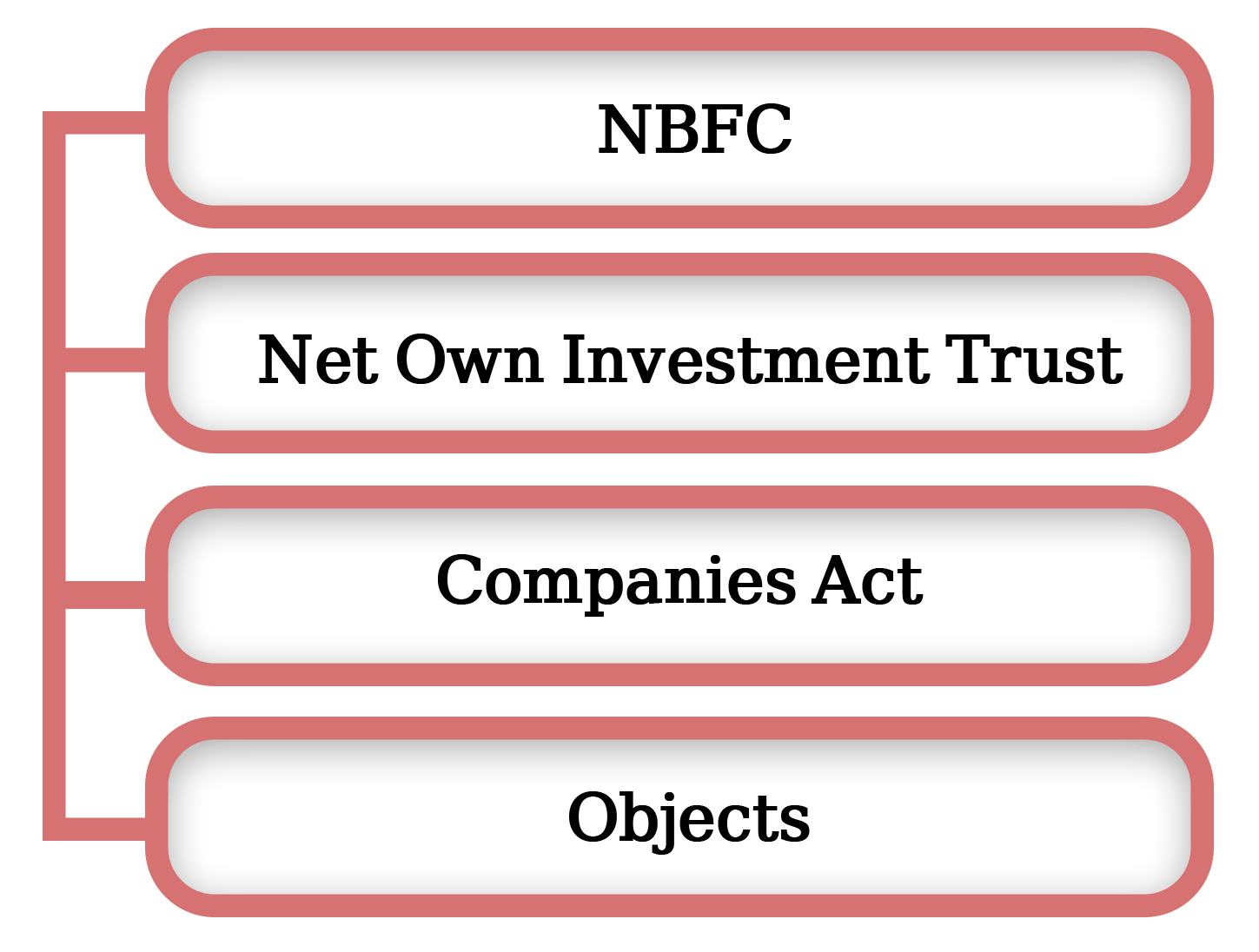

Criteria for Registration of a Housing Finance Company

According to Section 29A of the National Housing Bank Act of 1987, no HFC will begin or continue a housing finance case unless the accompanying conditions are met. For Housing Finance Company Registration, the following eligibility criteria must be considered:

NBFC

Under the terms of the Non-Banking Financial Firm Act, the housing finance company must be registered.

Net-Owned Investment Trust (NOF)

The Housing Finance Company's net owned fund must be at least 20 crores. As a result, in order to register a Housing Finance Company, an applicant must meet the net worth criterion.

Companies Act 2013/1956 registration

Under the Companies Act, 2013, or the Companies Act, 1956, the Company must meet the requirements of an entity.

Objects

This type of business must be used to finance homes and other commercial buildings. The company must be able to earn money in addition to providing financing. The management must behave in the public's and other consumers' best interests. They must act in the public's best interests.

The company's management and operations must behave in good faith and in the public's and other consumers' best interests. That means they must act in the public's best interests.

Various Regulatory Bodies in the Indian Housing Sector

The following are the several regulatory bodies that operate in the Indian housing sector:

- RBI (Reserve Bank of India).

- NABARD (National Bank for Agriculture & Rural Development).

- MCA (Ministry of Corporate Affairs).

- NHB (National Housing Board).

- SEBI (Securities and Exchange Commission).

Furthermore, the NHB (National Housing Bank) has established some guidelines for such financing companies, including the following:

- Classification of Assets.

- Assistance with finances.

- Income Acknowledgement guidelines that are prudent.

- Deposits are being taken in accordance with the rules.

It should also be highlighted that in order to follow India's housing finance sector, coordination between the Reserve Bank of India, the National Housing Bank, and the government is required. The National Housing Bank's primary responsibility is to oversee the lending process of Housing Finance Companies. The Reserve Bank of India, on the other hand, is primarily responsible for advancing funds to these Housing Finance Companies.

Basic Requirements for Obtaining HFC Registration

The following are the basic conditions that must be met for the granting of HFC Registration, as stated in section 29A subsection (4) of the National Housing Bank 1987:

- Housing Finance Company is or must be able to pay out all of its current and future depositors and investors as and when their claims arise.

- The Housing Finance Company's business activities and operations must not be, and are unlikely to be, conducted in a manner that is unfavorable to and unfriendly to the interests of both current and prospective depositors.

- The company's operations and policy management must not be detrimental to the general public's interest, as well as the interests of investors and depositors.

- An adequate capital structure is required for a House Finance Company.

- Better earnings prospects are required of a Housing Finance Company.

- Once awarded a COR (Certificate of Registration) to begin or continue commercial activities in India, an HFC must strive to serve the general public's interests.

- Any other condition or obligation that, in the opinion of the National Housing Bank, must be met in order to ensure that a Housing Finance Company's entry into or conduct of business in India will not be prejudicial and harmful to the general public interest or to the interests of investors or depositors.

Documents required for the registration of a Housing Finance Company

The following are the paperwork needed to register a Housing Finance Company in India:

- Provide a copy of the company's Articles of Association (AOA) and Memorandum of Association (MOA).

- Information on the company's profile.

- Obtain a demand draught for Rs 10,000/- payable to the National Housing Bank in New Delhi, as well as a Board Resolution (BR) stating the Company's goal and approval to file a registration application with the National Housing Bank.

- A comprehensive business plan outlining the company's goals and objectives for the following three years.

- Accept a certificate from any professional declaring that the company has reached the minimum NOF (Net Owned Fund) requirement of Rs 20 crores.

- CEO (Chief Executive Officer) or Director or MD (Managing Director) business profiles, etc.

- Information on all of the companies with which the directors are affiliated;

- Audit of the previous three years' financial statements.

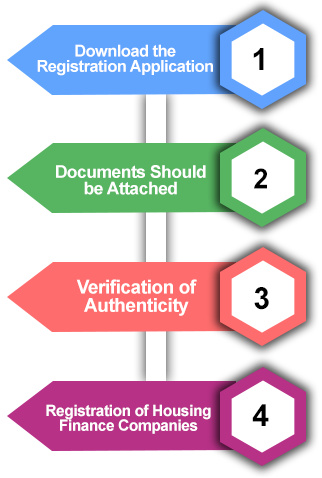

Getting a Housing Finance Company Registered is a Simple Process

The following are the steps in the process of acquiring a Housing Finance Company Registration:

Download the Registration Application

The applicant must first download the application form from the National Housing Bank's official website, nhb.org.in, as the first step in the process of acquiring Housing Finance Company Registration.

All Documents Should Be Attached to the Application

The applicant company must now attach all relevant papers to the application form in the following stage.

It must also attach a demand draught in the name of the National Housing Bank. The same needs to be filed to the National Housing Bank's headquarters.

Verification of Authenticity

The authenticity and legitimacy of the documents and application presented by the applicant will also be checked by representatives from the National Housing Bank.

Registration of Housing Finance Companies

The National Housing Bank will issue the applicant company a Certificate of Registration after reviewing the documents, annexures, and application form submitted. The same will be used as proof of registration for the Housing Finance Company.

Situations that Cause a Housing Finance Company's Registration to Be Cancelled

The following are the circumstances that lead to the cancellation of Housing Finance Company Registrations:

In India, the company ceases to operate or carry out its business functions and operations.

If a Housing Finance Company fails to comply with the following National Housing Bank specified terms and conditions: To comply with any guideline or directive issued by the NHB (National Housing Bank) under the provisions of Chapter V of the National Housing Bank Act 1987.

To keep accounts in accordance with any law, provision, instruction, or order issued by the NHB (National Housing Bank) under the provisions set forth in Chapter V of the National Housing Bank Act 1987.

When an inspection crew of the National Housing Bank demands or asks for its books of accounts and other essential papers, the company must comply with the conditions of the National Housing Bank Act 1987.

An order issued by the National Housing Bank, under the requirements of Chapter V of the National Housing Bank Act 1987, prohibits or restricts the corporation from accepting any deposit, and the order has been in effect for at least three months.

Post Registration Compliances for Housing Finance Company

The post registration compliances are as follows:

- Board Structure;

- Credit Risk Management;

- Development of Loan Policies, comprising of Appraisal Techniques & Tools;

- Development of the IT Infrastructure;

- Development of the Loan Processes;

- Drafting of Policies;

- Fulfilling Compliance Requirements;

- Legal Operations;

- MIS format;

- NHB Regulatory;

- Organizational Structure;

- Product Development;

- Resource Mobilization;

- Scoring Model;

Housing Finance Company Mandatory Compliance Requirements

The following are the mandatory compliances for a Housing Finance Company:

- Every Housing Finance Company is required to file an annual, half-yearly, and quarterly return in accordance with prudential standards and the management of liquid assets.

- Annual filing of the Auditor's Certificate attesting to the mentioned Housing Finance Company's ability to repay deposits.

- A copy of the financial statements that have been audited.

- A copy of the annual report that has been audited.

- Returns for changes of registered office must be filed on time.

- Returns for changes in directors, etc., must be filed on time.

- Providing a copy of the public deposit solicitation advertising or a statement in lieu of it.

- All provisions relating to IND-AS must be followed by Housing Finance Companies.

What is the distinction between a Housing Finance Company and a Bank?

Both Banks and Housing Finance Companies have activities and operations that entail making investments, deposits, and advances; yet, there are certain differences between them, which are as follows:

- Demand Drafts are not accepted by housing finance companies (DDs).

- Housing Finance Companies are not allowed to participate in the settlement and payment system and cannot write checks drawn on themselves.

- Unlike banks, depositors of Housing Finance Companies are not eligible for the Deposit Insurance and Credit Guarantee Corporation's facility.

Why Choose Us

Free Legal Advice

Transparent Pricing

On Time Delivery

Expert Team

Money Back Guarantee

200+ CA/CS Assisted

Lowest Fees

Easy EMIs

Frequently Asked Questions

For a housing financing firm to be registered, the following requirements must be met:

Companies Act 2013/1956; NBFC; Net Owned Fund (NOF) Registration & Objects

Banks and HFCs have comparable activities in that they both lend money and invest in businesses, but there are a few differences, as listed below:

HFCs can't take any kind of deposit, and they can't offer checks drawn on themselves because they don't frame any part of the payment and settlement system.

It is necessary to perform synchronization between the government, the Reserve Bank of India (RBI), and the National Housing Bank in order to realise this sector (NHB).

- The Reserve Bank of India oversees bank lending to the housing market.

- HFC financing to housing is regulated by the NHB.

9559179325

9559179325 9559179325

9559179325 9559179325

9559179325