Overview of Nidhi Company Registration

Nowadays, the concept of Nidhi Company has emerged as one of the popular lending mechanisms for acquiring secured loans and advances. In India, these companies are mostly predominant in the Southern Regions.

It shall be significant to state that the operations and management of this business format is very much parallel to that of a Co-operative Society. Further, section 406 of the Companies Act 2013, deals with the procedure for obtaining Nidhi Company Registration.

Concept of Nidhi Company

The term “Nidhi Company” denotes a type of NBFC that is regulated and administered by the provisions of the Companies Act 2013.

The only feature that differentiates this business format from the prevailing companies is that it deals only with its members. That means it accepts deposits from them and grants loans to them only, i.e., it works for the mutual benefit of its member.

Further, the activities of a Nidhi Company are regulated by the RBI. However, in some of the core provisions, the apex bank has excused the compliance from this format, as it operates only with the money of its shareholders.

Objective of Nidhi Company

The main object of this business structure is to incorporate the habit of saving within its member so that they can satisfy their financial needs with ease and smoothness.

Benefits of Nidhi Company

The benefits of a Nidhi Company are as follows:

- There is no need for any External Involvement;

- Easy to Borrow, Lend Money, or Raise capital from group members;

- Easy to Operate;

- Low Capital Requirement;

- Relaxed Compliances;

- Cost-friendly Registration Process;

- Several Privileges and Exemptions under the Companies Act 2013;

- Minimal Involvement of RBI;

- Secured Investment with Lower Rate of Interest;

- Low-level risk involved;

- Provides better Savings Option;

- Nidhi Company Rules acts as the Single Regulatory Body;

- Enjoys the status of a separate legal entity

- Better than a Credit Co-operative Society;

- Satisfies the Financial Needs of Lower and Middle-Income Groups;

- Members enjoy Limited Liability;

- Simple Processing;

- Easy Access to Public Funds;

Key Requirements of Nidhi Company Registration

The key requirements of Nidhi Company Registration are as follows:

- A minimum of 7 shareholders and 3 Directors are needed;

- Rs 5 Lakhs needed as the Minimum Capital Requirement;

- DIN for all Directors;

- No need to issue Preference Shares;

- The Nominal Value of each share should not be below Rs 10 per share;

- Every deposit holder must have a minimum of 10 equity shares of the corresponding value of Rs 100;

Documents Needed for Nidhi Company Registration

The documents needed for a Nidhi Company are as follows:

From Directors and Shareholders

- PAN Card for Members;

- Latest photographs of all the Members and Directors;

- Digital Signature Certificate;

- ID proof in the form of Voter ID, Aadhar Card, or Driving License;

- Address Proof for all Members and Directors;

- DIN for all the Directors;

For Registered Office

- Rent Agreement or the Lease Deed of the premise being used as the Registered Office; or

- Sale Deed for the premise being used as Registered Office;

- No-Objection Certificate from the landlord;

Documents to be Drafted by CA or CS

- MOA and AOA of the Company;

- MCA Attestation Form;

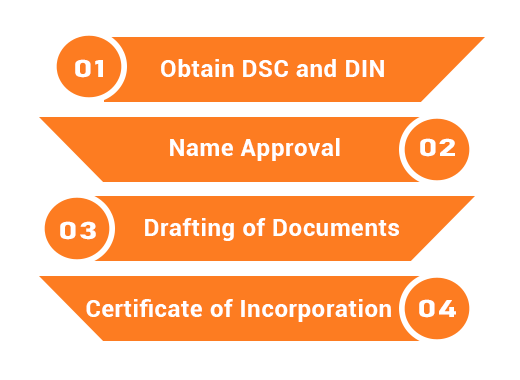

Procedure for Nidhi Company Registration

The steps involved in the procedure for Nidhi Company Registration are as follows:

Obtain DSC and DIN

The first thing required in the procedure for incorporation is to obtain DIN for all the Directors and DSC for at least one director.

Name Approval

Now, the directors of the company require to apply to MCA (Ministry of Corporate Affairs) for name approval by suggesting 3 names. Out of the names suggested, the MCA will select one for the concerned company.

However, it shall be taken into consideration that the name suggested must be unique in character and not same to any existing company’s name. Also, the name approved will remain valid only for 20 days.

Drafting of Documents

Now, the directors require to submit INC 32 as an application for registration, together with the AOA and MOA of the said company. However, the documents furnished must include the objective behind the incorporation of a Nidhi Company.

Certificate of Incorporation

After verification, the authorities will issue the Certificate of Incorporation with 15 to 25 business working days. It shall be noteworthy to state that this certificate acts as legal proof for the company’s incorporation. Also, this certificate will include the CIN (Company Identification Number) as well.

Post Registration Requirements

The Post-registration Requirements for a Nidhi Company are as follows:

- The company needs to mandatorily have at least 200 members by the end of its first financial year;

- The NOF (Net Owned Funds) of the company should not exceed Rs 10 lacs;

- The Ratio for the NOF to Deposits must be more than 1:20;

- Unencumbered deposits must exceed 10% of the outstanding deposits;

Maximum Limit for the Loans Provided by Nidhi Company

|

Amount of Deposits |

Maximum Permissible Limits |

|

If in case the total amount of deposits is below Rs 2 crores; |

Rs 2 Lacs |

|

If in case the total amount of deposits is above Rs 2 crores but less than Rs 20 crores; |

Rs 7.50 Lacs |

|

If in case the total amount of deposits is above Rs 20 crores but less than Rs 50 crores; |

Rs 12 Lacs |

|

If the total amount of deposits is Rs 50 crores or more; |

Rs 15 Lacs |

Mandatory Compliances for a Nidhi Company

The mandatory compliances after Nidhi Company Registration are as follows:

Form NDH-1

The directors need to furnish a list of members in this form, within 90 days, starting from the end of every financial year.

Form NDH-2

In case the company is unable to meet the goal of 200 members in its first financial year, it can submit a request for an extension in this form with the MCA.

Form NDH-3

The directors need to file a half-yearly return in this particular form.

Annual Returns with ROC

The directors need to file the company’s annual return in Form MGT 7 with the MCA (Ministry of Corporate Affairs).

Profit and Loss Statement and Balance Sheet

The directors of a Nidhi Company need to submit the financial statements and other required document in Form AOC 4 on an annual basis.

Income Tax Returns

The company needs to file its ITR (Income Tax Return) by 30th of every following year.

BIZ Process

Free Legal Advice

Transparent Pricing

On Time Delivery

Expert Team

Money Back Guarantee

200+ CA/CS Assisted

Lowest Fees

Easy EMIs

Frequently Asked Questions

Yes, it is compulsory to use the word “Nidhi Limited” as a suffix in the company’s name.

A minimum of 3 directors and 7 shareholders are required to incorporate a Nishi Company.

9559179325

9559179325 9559179325

9559179325 9559179325

9559179325