Overview of Public Limited Company Registration

In India, a Public Limited Company or PLC is the best business model for those embryonic entrepreneurs, who are planning big and dynamic, such as opening an IT company, setting-up of a manufacturing plant, etc.

Also, a Public Limited Company has all the rights and privileges that of a corporate entity, together with the characteristic of Limited Liability.

Moreover, some of the prominent examples of PLC are TATA Steel Limited and Reliance Communications Limited.

Concept of Public Limited Company

The term “Public Limited Company” is defined under section 2 (71) of the Companies Act 2013. It is a business model that has the feature of Limited Liability and raises capital from the general public by issuing shares in return. Further, a minimum of 3 directors and 7 members are needed for its incorporation.

Also, it shall be relevant to state that as per Companies (Incorporation) Rules 2020, there is no minimum capital requirement for a Public Limited Company.

Moreover, a subsidiary company for the purpose of registration shall be deemed to be a Public Company, even though it is listed as a private ltd company in its Articles.

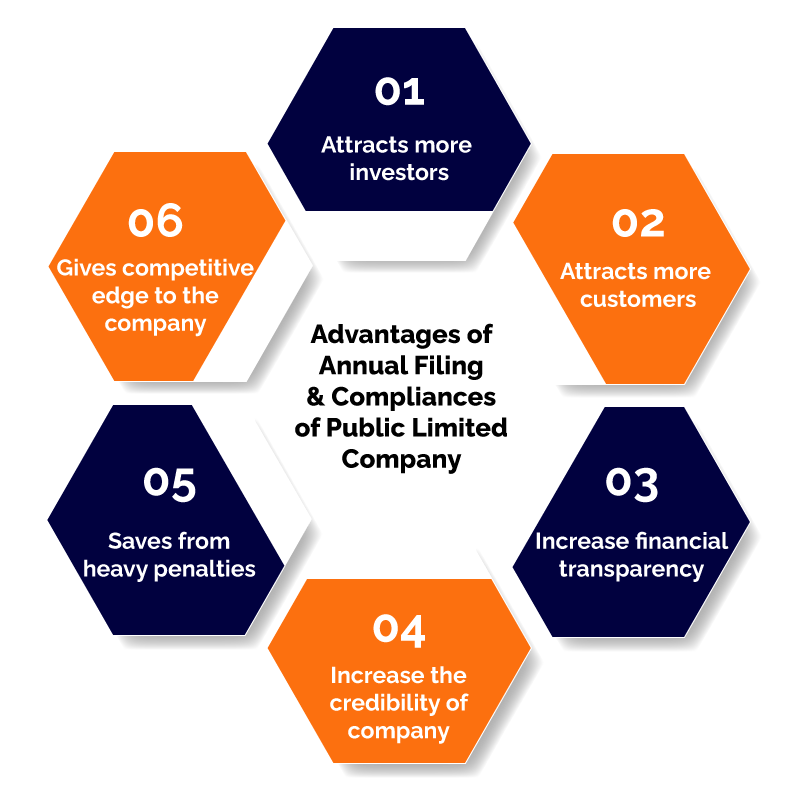

Advantages of Public Limited Company Annual Filing

Following are the advantages and benefits of the Public Limited Company Annual Filings and Compliances-

- Annual filing on time of a public limited company attracts more investors and customers in the market as it increases the financial transparency of the company. In simple terms, annual filing increases the credibility of the public limited company.

- Many times small startups or businesses do not do annual filing and basic compliances because of low funds or less knowledge which results in heavy fines and penalties. Regular annual filing avoids the heavy penalties and fines levied on the defaulted public limited companies.

- Fulfilling of annual filing and compliances give a competitive edge to the public limited companies.

- Annual filing helps to get a fair idea of the financial condition of the public limited company.

Public Limited Company Annual Filings

The Public Limited Company has to make a lot of compliances and filings every year, as compared to all other types of companies. Every company registered under the Companies Act 2013, in India, must do a lot of yearly filings as per the said Act. The major annual filings that Public Limited Company needs to do are given below.

Annual Return under Form MGT-7

This is one of the most important documents that almost every company needs to submit as annual compliance. Section 92 of the Companies Act, 2013 and the Companies (Management and Administration) Rules, 2014 talks about the concept of Annual Returns. Annual Returns provide the data of people who are behind the company. Things that need to be covered under Section 92(1), Annual Returns are given below-

- Annual Returns consist of the address of the registered office of the company, the object of business or company, and information regarding all the related companies, for example, the subsidiary company, holding company, associates’ company, etc.

- Annual Returns consist of the old name and new name of the company if the name of the company got changed.

- Annual Returns consist of the information regarding the shareholders/ members or debenture holders of the company with the charges as well since the last financial year

- Annual Return consists of the amount of loan that the company has taken and how much it needs to pay

- Annual Return consists of the salary that key managerial personnel and director get

- Annual Return consists of information regarding the meetings of the shareholders, board, and committees as well.

- Annual Return consists of the information regarding the directors, key managerial personnel, promoters, and the charges as well since the end of the previous fiscal year

- Penalties and fines are levied on the company and the directors or the officers along with details of the offense.

- Annual Return consists of the information related to the certification and compliances as given in the rules.

While submitting an Annual Return under Form MGT-7, it needs to be signed by a Director and the Company Secretary, and if there is no company secretary in the company then, it needs to be signed by the director. The Annual Return needs to be filed within sixty days from the date of the Annual General Meeting actually held or from the last of the date the Annual General Meeting should be held.

Financial Statement: FORM AOC-4

Section 2 (40) of the Companies Act, 2013 talks about the Financial Statement. And as per Section 2 (40), Financial Statement includes the following reports-

- Profit and loss account/income statement

- Balance sheet

- Cash flow statement

- Auditor’s report and Director’s report

- Consolidated financial statement

In simple terms, Financial Statement indicates the financial records and the financial position of the public limited company. It provides a broad financial picture of the public limited company, during a fiscal year. This document helps the shareholders and public in knowing the true financial position and activities of the company. Financial Statements can be of two types. The first one is Annual Financial Statement that needs to be prepared and filed annually. The second one is the Quarterly Financial Statement which needs to be prepared four times a year by listed public limited companies as per the requirements of SEBI rules.

Annual Financial Statement needs to be filed to the Registrar in Form A0C-4 along with the consolidated financial statement, Board’s Report, and Auditor’s report every year within thirty days from the date of the Annual General Meeting for each fiscal year. The form shall be signed by the professional company secretary in practice.

Appointment of Auditor: Form ADT-1

Section 139 of The Companies Act, 2013 says that every company is under obligation to inform the Registrar of Company (ROC) regarding the appointment of the auditor. When a public limited company is appointing a new auditor, it shall inform the Registrar of Company, through Form ADT-1.

In the case of the newly incorporated public limited company under the Companies Act, 2013 the notice of the appointment of the auditor, through form ADT-1 shall be filed within 15 days from the first board meeting of the company that should be taken place within thirty days from the date of incorporation.

In the case of an existing public limited company, the notice of appointment shall be filed to the Registrar within fifteen days from the date of the meeting in which the respective auditor is appointed. Every company is under obligation to file this form every year. Only the company is responsible to file from ADT-1 and not the auditor. This form needs to be filed even if the appointment of the auditor is for a casual opening.

KYC Details of Directors: FORM DIR-3 KYC

Every DIN holder, i.e., the director needs to file form DIR-3 KYC every year. DIN (Director Identification Number) is an eight-digit unique identification number that is provided to the person who wants to be a director for a lifetime. Initially, this DIN could be got through the filing of DIR-3 only and was a one-time process. But now MCA (Ministry of Corporate Affairs) made it compulsory to file DIR-3 KYC every year by the directors.

Who Needs to File Form DIR-3 KYC?

Recently, through a circular, MCA announced that every director who has been allotted DIN till 31st March 2018 having the status of approved shall file this form. It is also compulsory for the directors who are no more qualified to hold the status of a director.

Further, MCA directed that from the fiscal year 2019-20, every person who has been allotted DIN on or before the end of the fiscal year having the status of approved on it shall file form DIR-3 KYC before 30 September of the immediate next fiscal year.

Non-Compliance with the Annual Filing of Form DIR-3 KYC

If the director who was supposed to fill this form could not file it by 30th September, then his or her DIN number will be marked as “deactivated due to non-filing of form DIR-3 KYC” by the MCA department.

The Return of Deposit: Form DPT 3

Every company which has taken any kind of loan or money needs the

Every company which has taken any kind of loan or money needs to submit from DPT 3 every year. After consultation with the Reserve Bank of India, the Central Government has taken this step to provide an extra layer of security to the interest of creditors and depositors. The form DPT 3 form can be filed in two forms a one-time return and an annual return. The annual return shall be filed by 30 June of every year.

Consequences of not Adhering to the Requirements Given Under Form DPT 3

If a company does not file from DPT 3 and continues taking deposits, then it will be levied with huge compensation. As per Section 73 of the Companies Act, 2013 a penalty of minimum rupees 1 crore or the amount twice of the deposits, whichever is lower, shall be paid by the company. The maximum amount can go up to rupees 10 crore. Every officer in default shall get imprisonment for up to seven years and need to pay the fine not less than rupees 25 lakhs which may extend up to rupees 2 crores.

Rule 21 of the Companies (Acceptance of Deposits) Rules, 2014 says that every company and officer in default will be liable to pay a fine which may extend up to rupees 5000, and for continuing the default rupees 500 for every day from the date of default.

Disclosure of Director’s Interest: Form MBP 1

According to Section 184 (1) of the Companies Act, 2013 every director shall disclose his interest in any body corporate, any company, firms, or in any association of individuals in any form before the first meeting of the board and at the first meeting of the board in every financial year. And if any change in interest took place, then he must disclose it in the first meeting held after the change in interest. Director needs to file this form every year stating his any interest or no interest in the respective firm, company, body corporate, or association. The non-compliance with this form will result in imprisonment which may extend up to 1 year or a fine which may extend up to rupees 1 lakh or both.

Filing of Secretarial Report: Form MR-3

According to Section 204 of the Companies Act, 2013 and Companies (Appointment and Remuneration of Managerial Personnel), 2014 every listed public company and a public limited company having paid-up share capital of rupees fifty crores or more than that of it, or every public company that has a turnover of rupees two hundred fifty crores or more than that of it, or a company which has taken loan from any bank or public financial institution need to submit secretarial audit report provided by a practicing company secretary through form MR-3.

Adoption of Financial and Director’s Report: Form MGT-14

This form needs to be filed for any resolutions and agreements undertaken by a public limited company in a board or shareholder meeting. Form MGT-14 shall be filled within thirty days from the date of signing of agreement or passing of the resolution with the Registrar of Company (ROC). If the company is in default, then the penalty of minimum rupees one lakh shall be paid by the company. In the case of continuous default, rupees 500 per day will be charged which may extend up to rupees 25 lakhs. If the officer is in default, then the penalty of maximum rupees fifty thousand shall be paid. In the case of continuous default, rupees 500 per day will be charged which may extend up to rupees 5 lakhs.

Report on Annual General Meeting (AGM): Form MGT 15

According to Section 121 (1) of the Companies Act, 2013 and Rule 31(2) of the Companies (Management and Administration) Rules, 2014 every public listed company needs to file a report on the Annual General Meeting (AGM). The report will give confirmation that the meeting was summoned, held, and executed properly within the scope of the Companies Act, 2013 and Rules.

The copy of the report shall be submitted to the Registrar of Company (ROC) through form MGT 15 within 30 days from the date of AGM. The minutes of the meeting shall be included in the copy.

As per Section 121 of the Companies Act, 2013 a penalty of rupees 1lakh rupees will be paid by the company. In the case of continuous default, rupees 500 per day will be charged which may extend up to rupees 5 lakhs. If the officer is in default, then the penalty of maximum rupees fifty thousand shall be paid. In the case of continuous default, rupees 500 per day will be charged which may extend up to rupees 1 lakh.

Income Tax Return

Every public limited company needs to file an income tax return every year. According to Section 234A of the Income Tax Act, a penalty of 1 percent of the total amount on which tax needs to be paid will be levied on the company for not filing the Income Tax Return. The interest is calculated from the due date till the actual date on which the company will file an income tax return.

Who are Bizadvisors?

Bizadvisors is a platform that helps people in filing online legal forms. It provides a full range of accounting, Legal Compliances, Tax & Regulatory and certification, etc. It also helps in registering companies and provides professional assistance. You can get any kind of legal advice or if you won't get your company registered then we are just one call or text away. Following are the reasons, you should choose BizAdvisors-

.png)

- Bizadvisors provide professional assistance, for example, Charted Accountants and Company Secretary, etc.

- Client access and track the progress of work at any time.

- We try our best to provide you the smooth client counseling.

- We provide free legal advice as well.

- We provide our service in a time-bound manner, so that money and time of the client can be saved.

FAQs Regarding Public Limited Company Annual Filings

A public limited company is a company that can offer or issue its shares or securities to the public at large and has limited liability. A public limited company is completely free to list itself on the stock exchange and trade on it, or a public limited company can raise capital from investors in form of IPO (INITIAL PUBLIC OFFER) and FPO (FOLLOW ON PUBLIC OFFER).

As per Section 2(71) of the Companies Act, 2013 a public company is a company that is not a private company. For incorporating a public company, it is compulsory to have at least seven members as given under Section 3(1) of the Companies Act, 2013, and at least three directors as given under Section 149 (1) of the Companies Act, 2013. Section 4(1) (a) of the Companies Act, 2013 says that it is compulsory to end the name of a public company with the word Limited.

9559179325

9559179325 9559179325

9559179325 9559179325

9559179325