GST registration in Uttar Pradesh puts enterprises in the state under a unified tax system. It has reduced tax complexity because multiple tax systems were confusing for taxpayers and this resulted in the incorporation of a single tax system. A service provider that provides services of more than Rs.20 lakh turnover and supply of goods of more than Rs. 40 lakh turnover is required to get the GST registration. If the business which is required to register does not register, then it will be considered an offense under CGST Act, 2017 and heavy penalties will be levied on them.

What are the Components Of GST?

Before understanding the GST registration process in Uttar Pradesh, let’s know the components of GST in India and they are as follows:-

• CGST: This is a central government tax on intra-state sales. It is collected by the central government.

• SGST: This is the tax that the state government imposes on intra-state sales.

• IGST: This is a central government tax on inter-state sales (e.g. Uttar Pradesh to Tamil Nadu).

• UTGST: It is applicable when any services and goods are consumed in the Union territories (UTs) of India. It is collected by the government of the union territory.

Persons who can Take GST Registration in Uttar Pradesh

Apart from the turnover limit mentioned above, there is a list of certain businesses for which GST registration in Uttar Pradesh is mandatory irrespective of their turnover:

1. Persons making any Inter-state taxable supply

2. Casual taxable persons making taxable supply

3. Persons for who should mandatory pay tax under the reverse charge

4. Non-resident taxable persons making taxable supply

5. Persons who should deduct tax

6. Persons who make taxable supply of goods or services or both on as an agent or otherwise

7. Input Service Distributor

8. Every electronic commerce operator

9. Every person providing online information and database access or retrieval services from a place outside India to a person in India

10. Such other person or class of person may be notified by the government.

Persons who can not Apply for GST Registration in Uttar Pradesh

Persons or classes of person who are not required to register for GST in Uttar Pradesh are as follows:

i. Supplier of exempted/non-taxable goods

ii. Agriculturist

iii. Persons making reverse charge supplies

iv. Following are exempted from registration under section 23(2) of the CGST Act 2017

- Individual advocates (including senior advocates)

- Individual sponsorship service providers (including players).

v. Notified persons:-The Government, on the recommendations of the GST Council through notification will specify the category of persons who may be exempted from obtaining registration under this Act.

Documents Required for GST Registration in Uttar Pradesh

The following are the documents required for GST registration in Uttar Pradesh:

Documents required for registering your business under GST in case of a sole proprietorship

- Applicant’s PAN (Permanent Account Number)

- Mobile number

- E-mail address

- State or Union Territory

- Copy of Aadhaar

- Documents of Incorporation certificate or business registration

- Bank account statement/cancelled cheque

Documents required for Private Limited Company, Public Company (limited company)/ One Person Company (OPC)

- Company document

- PAN card of the company

- Registration Certificate of the company

- Documents of Memorandum of Association/ Articles of Association

- Copy of Bank Statement

- Declaration to comply with the provisions

- Copy of Board resolution

- Director related documents

- PAN and ID proof of directors

- Registered Office documents

- Electricity bill/ landline bill, water bill

- No objection certificate of the owner

- Rent agreement

Documents required for a Hindu Joint Family

- HUF PAN Card Passport-sized photograph of the Karta.

- Karta’s ID and address evidence

- Address evidence of the business.

- Details of your bank account

Procedure for GST Registration in Uttar Pradesh

The steps to be followed for GST registration in Uttar Pradesh are as follows:

Step 1: Visit GST portal through the official website of GST

For the purposes of GST registration in Uttar Pradesh, the applicant requires to visit the GST portal at www.gst.gov.in and click on the service tab.

Step 2: Click on New Registration

Under registration, there are three options such as New Registration, Track Application Status, and application for Filing Clarifications. Click on “new registration”.

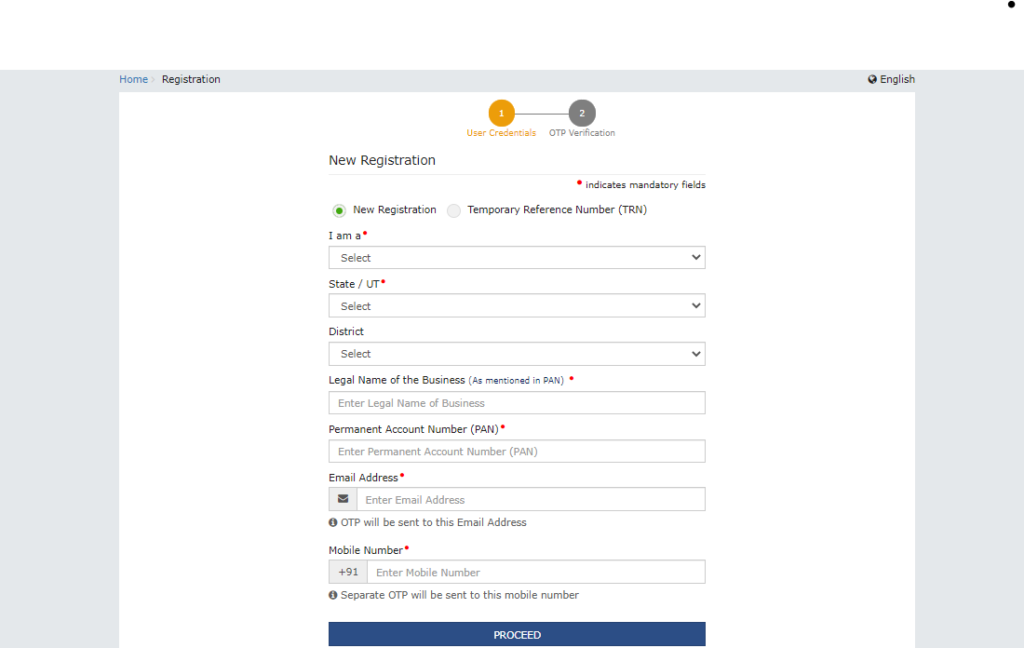

Step 3: This page will direct the applicant to a new page, as shown below

The application form consists of two parts, Part A and Part B. The picture below shows Part A of the form which is the “new registration” form. The applicant is required to fill in the necessary details.

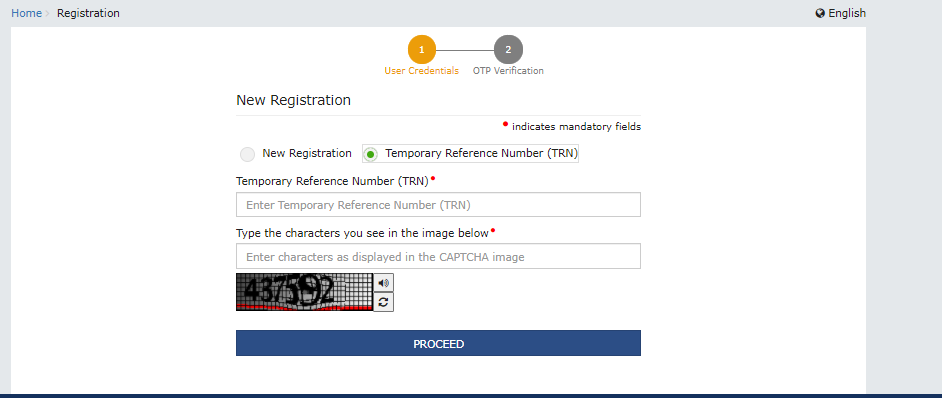

After clicking on “proceed”, the page will display the Temporary Reference Number (TRN)

NOTE: the validity of this TRN is 15 days only. The applicant should complete Part B within these 15 days.

Step 4: Fill out Part B of the application

To complete the GST Registration in Uttar Pradesh, the applicant is required to fill out Part B of the form.

Step 5: Click on the action button to complete the filling of the form.

The applicant should log in to their respective accounts and fill in the required details in all nine tabs displayed on the page and click on continue.

Step 6: Verification-

The users will have to submit a Digital Signature Certificate (DSC) to authorize the application.

Note: DSC is compulsory in the event of LLP and Companies

Step 7: Submit the details

Check the submitted details, click on Submit and then Proceed. When the submission is successful, a message regarding the submission will be displayed on the screen. This completes the GST registration in Uttar Pradesh.

GST Return is Filed After GST Registration in Uttar Pradesh

A GST return is a document that contains all the details of a sale, purchase, a tax levied on the sale, and tax paid on the purchase. Once you have done with your GST return filing, you will have to pay the resulting tax obligations (the amount you have to pay to the government). All business owners and sellers registered under the GST system are required to file a GST return appropriate for the nature of the business or transaction.

For late filing of GST return:

Overdue fees incur a penalty called late fees. The late fee is Rs.100 per day. In other words, it is 100 rupees for CGST and 100 rupees for SGST. The total will be rupees 200 per day. The maximum is Rs. 5,000. If your submission is delayed, IGST will not charge you a late fee.

For not filing GST return:

If you do not file a GST return, you will not be able to submit any further GST returns. Therefore, delaying the filing of a GST return will result in heavy fines and penalties.

Conclusion

Everyone dealing with taxable goods and/or services is required to register for GST to avoid penalties or litigation. When proper registration of GST is done, you can enjoy the benefits and meet your customers’ demands. It is more consumer-friendly. GST registration in Uttar Pradesh is done with the help of the simple steps mentioned above. It is done online and the applicant can receive approval within a few days of registering if the documents submitted are proper.

Read our article:How to Get GST Registration in Karnataka

9559179325

9559179325 9559179325

9559179325